Following my quarterly commentary sent at the beginning of April, I had planned that my next one would be in July for the Q2 2022 review. However, since things change very rapidly, I decided to send a shortened commentary for the month of April.

Depressing? These are not pleasant times I agree, but it is part of investing in the stock market. Once again, I repeat myself, but the important thing here is to keep the objective in mind and let time do its work. Emotions drive the market in the short term, but not in the long term.

Despite the headlines, it’s not all bad news in the markets right now. We are currently in the “earnings season”, the period when corporations reveal their financial results for the last quarter. Based on recent market movements, one would be tempted to believe the results have been disappointing so far, but on the contrary. In fact, as of last Friday, 77% of companies that released their results performed better than expected (Source: Credit Suisse). This good news, however, has been buried by interest rate expectations stemming from fears of inflation and its impact on the economy (see my Q1 commentary). Although macro news dominates the headlines at the moment, eventually good fundamentals will be rewarded. I also believe that the worst is mostly behind us with respect to bonds. It is of course impossible to predict the absolute bottom, but as many increases are already anticipated by the markets, the future seems more promising for the asset class. High-quality bonds should therefore fulfill their role of diversification and protection in a portfolio well when it is needed in the future.

Returns have been disappointing recently, but let’s still remember that including this decline, we have still had exceptional returns in recent years. Technology (represented by the NASDAQ index) is up 106% over the last 5 years and the US market (represented by the S&P 500) is up 74% over the same period. Corrections like what we are currently going through give markets a necessary “reset” for the uptrend to eventually return.

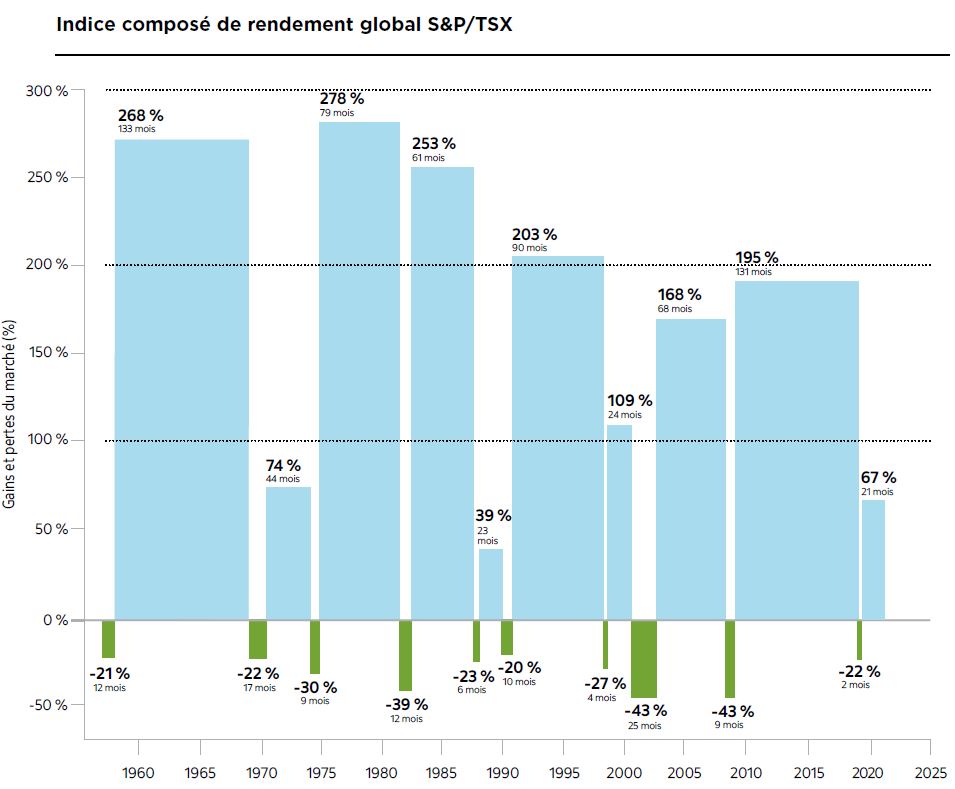

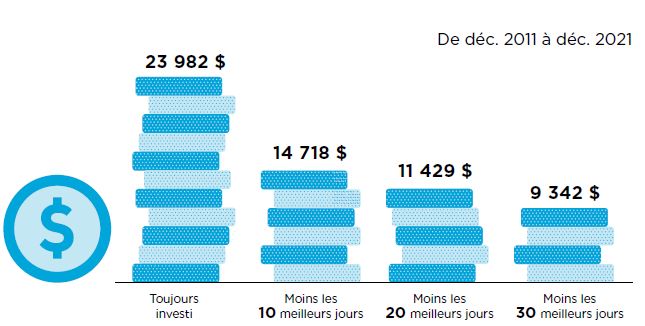

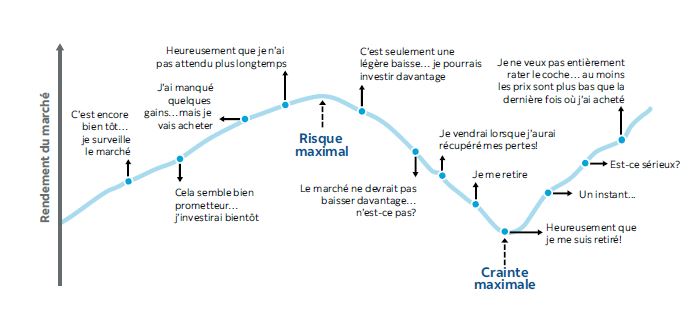

Before my quiz question, here are some illustrations that clearly demonstrate the market volatility we talked about and the importance of staying invested through these periods. Significant declines are common, but increases are even more so. Periods of high volatility, like the one we are currently experiencing, are also periods during which there are significant days of upside volatility (no need to look further than mid-March 2022). The second chart shows the impact missing the best days has on a long-term investment. The third chart shows the normal cycle of investor emotions. See if you recognize yourself in it (but I’m sure you won’t…!)

Quiz question

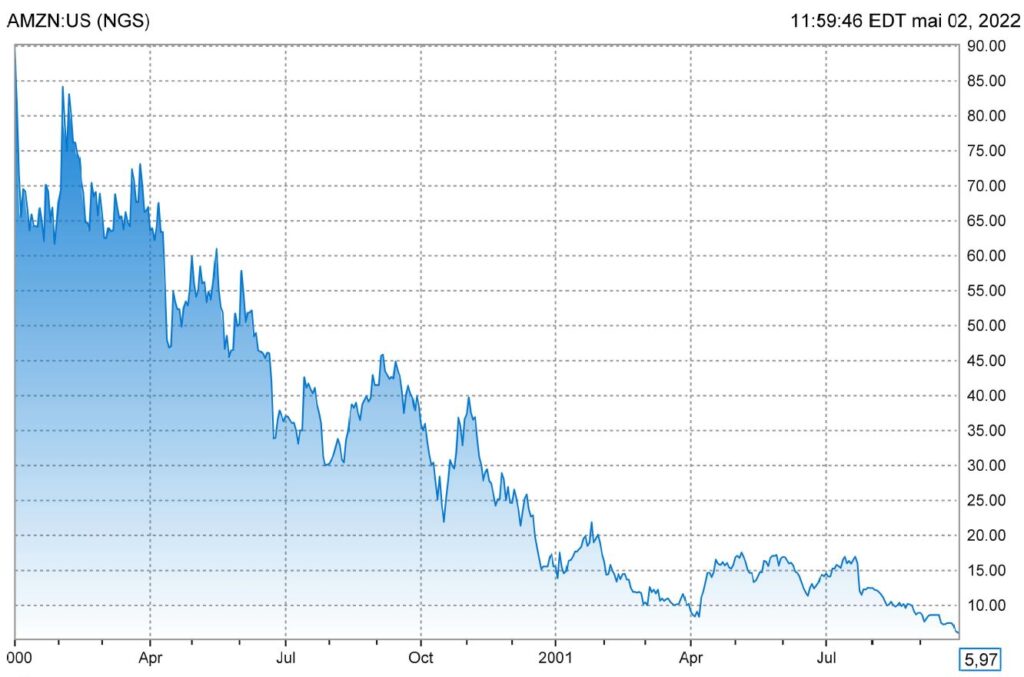

Here is the stock price chart of a very well-known company between December 10, 1999, when the stock was trading at $111.40 USD, and September 28, 2001, when the stock was now trading at $5.97 usd. This variation represented a drop (note the use of “drop”, not “loss”) of 94%. Can you tell me which company it is? Hint: This company still exists and is known worldwide. Would you have kept your shares? Or even, would you have invested in that company?

Here is the evolution of the stock of this company thereafter, between September 28, 2001 and May 2, 2022:

If you had said Amazon, good answer! (A 40,061% return for those wondering).

Now, we agree that Amazon is a special case (although not the only one) of phenomenal growth over time, but few people remember that at some point they had lost 94% of their stock market value. Amazon wasn’t the company it is today in 2000 and 2001, but it had already evolved considerably from its book-selling origins. In 1999, they had already sold 20 million items (books, CDs, toys, electronics, tools, etc.) in 150 countries around the world. In the year 2000, they had opened their platform so that merchants outside of Amazon could use it to sell their products.

It goes to show that while investing, emotions are not always good advice in the most difficult times.

I hope you enjoyed this read and I am always available if you have any questions/comments.