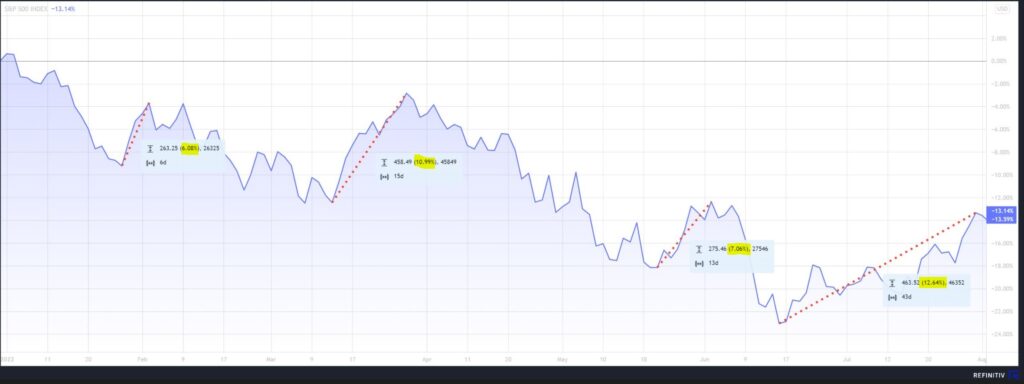

Is it here to stay? Hard to say because despite the results we have known since the beginning of the year, you may be surprised to learn that we have already had four rebounds of more than 6% between January 1 and July 31, 2022. , including two of more than 10% (see graph below). The evolution of new data on different factors will determine whether the rebound can be sustained or not. Caution and patience are required.

July 2022

- “Earnings season”: In my comment last month, I spoke about the “earnings season” (period when companies report their financial results for the last quarter) saying it would have a significant impact on the direction of markets in the coming weeks; and this is mainly what guided them during the month. As of August 3, 2022, 72% of S&P 500 companies that reported their results beat market expectations (Source: Credit Suisse).

- Recession: I also mentioned last month a possible “technical” recession that would be announced in July. It materialized with the announcement of US GDP figures (indicator of the US economy), which revealed two consecutive quarters of negative growth. For now, that doesn’t mean much since some particular factors contributed to this data. On the other hand, the evolution will need to be monitored in the coming months because until now, although the majority of the figures released have been positive; the results were still contradictory at times. Consumers remained resilient despite extremely low sentiment indices, which supported the economy. Unemployment rates also remain at historic lows and the number of job openings is down.

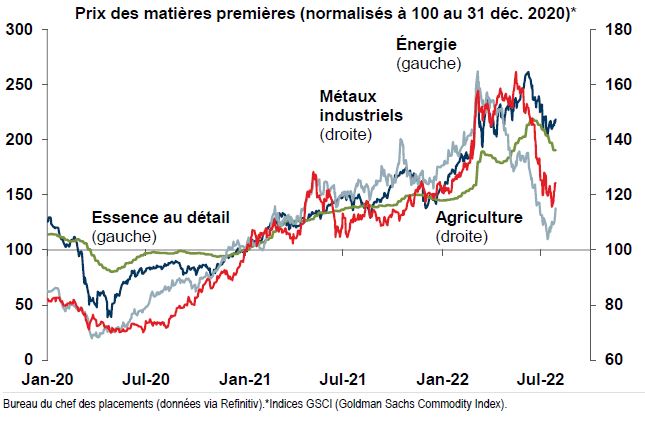

- Inflation: Also discussed in last month’s commentary, several positive signs related to inflation were beginning to surface in recent months and inflation expectations declined further in July. The United Nations Food Price Index was down in July for a 4th consecutive month, now lower than where it was before the invasion of Ukraine. Oil prices also continued their descent during the month, helping the markets to anticipate a drop in inflation in the coming months. We also see demand shift rapidly from goods (televisions, household appliances and other durable goods) to services (transportation, travel, hotels, restaurants, etc.); which helps calm inflation on goods while supply chains regain the upper hand.

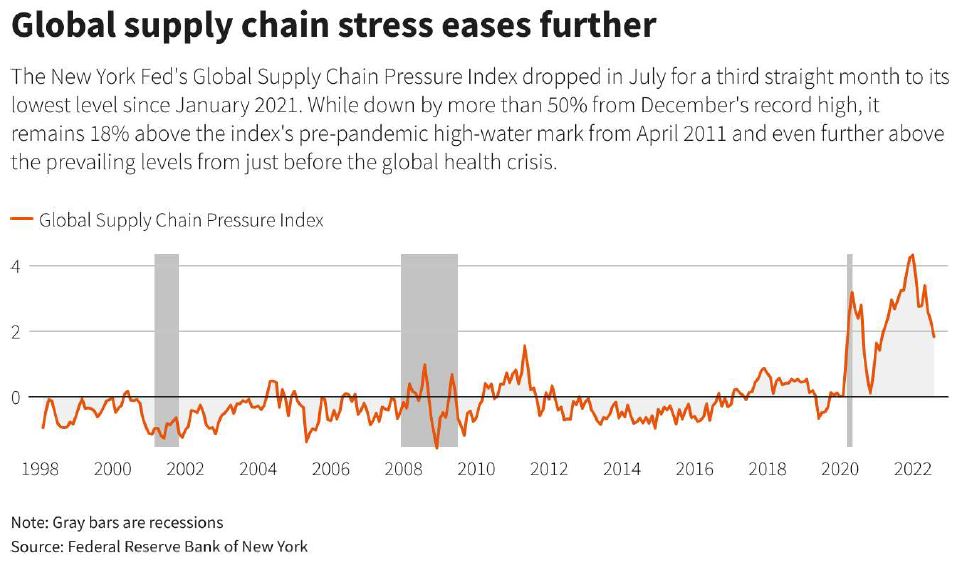

- Supply chains: The good news on this side continued to improve on several points. Supply chain pressures continued to decline according to the New York Fed in July, now down more than 50% since December 2021 (a decline is positive here since it means a drop in the pressures causing problems). Delivery times also continued to improve during the month, according to the S&P Global and JP Morgan index that tracks this data.

Outlook for the coming months

July was a welcomed month, as good returns can often come at times when you least expect them. With the corporate earnings season now largely behind us, the other key points to watch for the coming months remain unchanged for now. The fine line to navigate between inflation control and recession is not straightforward and will continue to command attention. We are going through a period where good news on the economy should not be too good, otherwise the risk of inflation increases; but also, where good news on inflation should not be too good either, otherwise the risk of recession increases. I continue to believe that the chances of a severe recession remain low given the current scarcity of labour. Some sectors will be more impacted than others by the ongoing pressures. From technology companies that had overstretched during the pandemic and already began downsizing their workforces, to home prices that soared due to very high demand and low interest rates; a return to normal in certain sectors would only be normal and potentially beneficial.

As strange as it may seem, fears of recession helped the markets to have a good month in July. Indeed, these fears have pushed interest rates down. Such a drop benefits stocks as well as bonds, which partly explains why the two asset classes had a good month in tandem. Obviously, this factor must be coupled with others to produce positive returns such as stable profits for companies, lower inflation expectations, the state of the supply chains improving, etc.

As in past months, I continue to see positive signs in several sectors. On the other hand, as mentioned previously, I believe that caution and patience are still in order at the moment since these signs will have to materialize and show a sustained trend before we can really rely on them. Good diversification within portfolios is important in such markets.

Things to watch for in August:

– August 4: Unemployment rate in the United States (result 3.5%)

– August 5: Unemployment rate in Canada (result 4.9%)

– August 10: Inflation data in the United States

– August 16: Inflation data in Canada

– August 25: Estimated data on GDP in the United States

– August 26: Data on “core” inflation in the United States

– August 30: Consumer confidence in the United States

– August 31: Data on GDP in Canada

Do not hesitate if you have any questions/comments or if you would like to discuss this further.