The last few downturns got us used to very quick rebounds and the expression “buy the dip” became the norm. All we had to do was invest more when the markets were falling, and we were rewarded within a few weeks/months. The markets in 2022, however, have been difficult to navigate in a way we haven’t seen in a long time. Some are now asking the question, is “buy the dip” dead?

The answer actually depends on your point of view. The idea of investing (or continuing to invest) when markets are falling is still a smart strategy, but you must have a reasonable time horizon. In recent years, “buying the dip” has worked quickly and in the short term, which explains the rise in popularity of the expression. However, applying a systematic investment strategy (investing as much when the markets go up as when they go down) over the long term brings undeniable benefits. Here is a concrete example to illustrate this.

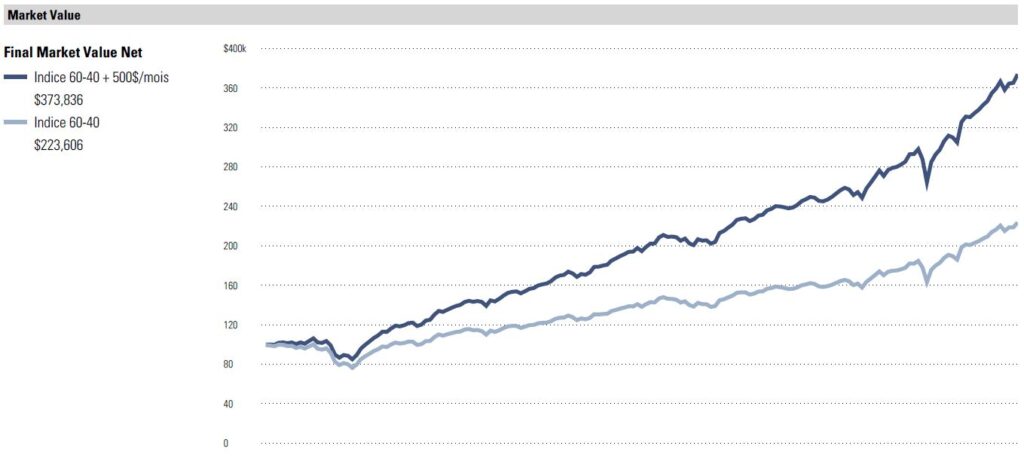

To keep it simple, let’s take the case of two investors with an identical portfolio consisting of a balanced exchange-traded fund with 60% in equities and 40% in fixed income. The two investors each invested $100,000 on June 21, 2007, i.e. before the great financial crisis of 2008. The two starting portfolios are identical with the same amount invested at the same time. However, one of the two investors will never add to his investment, while the second will continue to invest $500/month.

Here is the hypothetical value of the investments on December 31, 2021:

- Portfolio without automatic investments: $223,606

- Portfolio with automatic investments: $373,836

- Total difference between the two scenarios: $150,230

- Additional amount invested in the 2nd scenario: $87,500 ($500/month for 175 months)

In the end, adding $500 per month to the 2nd investor’s portfolio would have made him invest an additional $87,500. However, his portfolio would be worth more than $150,000 more than the first investor who never added to his. Why did this happen? This increase in value of nearly $63,000 ($150,000 – $87,500) is the result of several factors. First, systematic investing takes emotion out of the equation so that even in 2007 and 2008, when the markets were experiencing a significant downturn, the investments continued and allowed the investor to invest at lower prices. This was also the case during every downturn that occurred between 2007 and the end of 2021. These lower-priced securities benefit more from rebounds because they were purchased “at a discount”. Secondly, one should not underestimate the effect of compounding returns, which means that the longer the amounts are invested, the greater the returns in dollars become since you are now making returns on returns. For example, you gained a 5% return on your $100,000 investment in the first year, so $5,000. The second year, you still get a 5% return, but this time on $105,000 ($100,000 + $5,000). Your investment then increases by $5,250 (instead of $5,000 the first year) even though you did not add any money of your own. And so on for each subsequent year.

With systematic investments, the 2nd investor invests as much during market downturns as during market upswings; thus, removing emotions from the investment decision. There is no need to “wait for things to calm down” or “wait for a pullback” before investing.

So “buying the dip” is not dead, as long as you remember that sometimes the dip can last several months before recovering. You just have to be patient.