Canadian and U.S. equities, as well as international equities, had a good month in October 2022. Unfortunately, it’s not all good news as bonds and emerging market equities ended the month in the red once again.

Several factors influenced the rise in October, but the most important factor was, you guessed it, the hope that inflation would finally come down soon. However, the U.S. equity indexes fell back to their 2022 lows by mid-October before rising again on some positive economic data.

Recession

This month, instead of focusing on the stock market movements in October, I thought I would delve into the current topic that you probably hear about the most: a recession. It’s a scary topic on the surface and one that is mentioned more often than not in the media. So, what about a recession and how might it impact you and your investments?

First of all, what is a recession and when are we in one? You may recall my article earlier this year (see here) where I discussed the signs of a technical recession in the U.S., defined as two consecutive quarters of declining Gross Domestic Product (GDP). This is a sort of rule of thumb often used when talking about recessions, but it is not recognized as the official indicator. For a recession to be “official” in the U.S., it must be declared by the National Bureau of Economic Research (NBER) and be defined as “a significant decline in economic activity, spread across the economy and lasting more than a few months” according to the White House (source). In Canada, it is the Bank of Canada or the Minister of Finance that officially declares a recession, and the criteria are quite similar.

What impact can a recession have on you? Whether it’s a temporary slowdown in your business sales, a short-term drop in your investment portfolio, or a slowdown in your work activities for a period of time, the impact would be different for everyone. Some might be more affected, while others might not be affected at all. The thing to remember is that recessions are normal, healthy, and temporary.

Now, a recession being a slowdown in economic activity, there will of course be effects on your investments since these evolve, in the long run, largely according to the financial results of the companies in which you invest. This means that if the general economy slows down, companies should see their revenues and profits decrease for a certain amount of time. However, as mentioned many times in the past, financial markets look at the future and not just the present. They therefore usually react before events are made official and when they are, markets are already looking ahead. So, there is already some of that recession risk discounted in your investments today and that explains some of the decline this year in anticipation of a possible recession.

As an example, consider the 2008 financial crisis. It is deemed to have lasted from December 2007 to June 2009. Although these are the dates generally accepted today as the “official” dates of the financial crisis, they were not determined during the crisis itself. It is much the same as in the financial markets, i.e., one does not know that the bottom has been reached until well after it has actually been reached. Indeed, the official NBER announcement in the United States was only published on December 1, 2008, a full year after the “official” start date of the recession we now know today (see the official NBER announcement here). What about our side of the border? The Bank of Canada announced that the Canadian economy was in recession 8 days later, on December 9, 2008 (see the official BDC announcement here).

What am I getting at with these official announcement dates? They reinforce the point that financial markets act in anticipation of upcoming events rather than in reaction to them. Now don’t get me wrong, markets DO react to occurring events, but mainly to events that were not expected. I have created the following charts of the S&P 500 (U.S. stocks) and the S&P/TSX (Canadian stocks) for the period between December 1, 2007 and June 30, 2009 to illustrate this point:

It is very clear that most of the decline had already taken place before the official announcement of the recession, both in the U.S. and in Canada. In both cases, the markets were up shortly after.

Obviously, the past is not always a guarantee of the future, but it does describe how the stock market works in general. This year is no exception. The decline so far in 2022 considers part of the current recession risk, so the official announcement would not necessarily mean a new drastic market decline since they have already been reacting in anticipation of this possibility for several months. Such an announcement could of course still bring short-term volatility.

Now whether or not we will have a recession, I think the chances of avoiding it are getting slimmer as things progress. Nothing is set in stone yet, but let’s say it’s increasingly likely. A recession is not necessarily a bad thing. On the contrary, it can sometimes be beneficial to allow a sort of “reset” and establish a solid foundation for the future.

Inflation and interest rate hikes

Interest rate hikes to calm inflation are starting to work and we see inflation on goods decreasing. The decline could accelerate rapidly in the future as well. On the services side, inflation seems to be more entrenched and will be more difficult to tame. On the other hand, interest rate hikes take time to be reflected in the economy and they act with a delay. This is why at its meeting at the end of October, the Bank of Canada decided to raise its interest rate by 0.50% rather than the 0.75% that was largely expected (article). This shows a sign of caution by the Bank as it begins to see impacts on the Canadian economy, particularly on the real estate sector.

The U.S. Federal Reserve (FED) kept a restrictive tone regarding its future strategy on interest rates during its announcement last week. The FED chairman mentioned that the terminal rate could be higher than previously anticipated, but he also hinted that smaller rate hikes are being considered for their next meetings. The markets did not react well to this mixed news between good and bad, giving more importance to the portion on the higher terminal rate than the one on smaller hikes to come. I believe Jerome Powell, the FED Chairman, could not afford to sound too dovish in his speech since the impacts would have been counterproductive to what he is trying to accomplish. An overly accommodative tone could have pushed the markets higher, loosening financial conditions and giving a second wind to the inflation they are desperately trying to control.

Higher interest rates will slow down the economy, but the stated goal of central banks is not to create a recession. However, the FED has suggested on a few occasions that its primary goal is to control inflation, even if the economy suffers in the process. We are currently seeing a sharp slowdown in certain sectors of the economy, such as technology, which are more sensitive to interest rates and have benefited from lower rates for years. Layoffs are now becoming more frequent (CNN). Despite this, the unemployment rate in both Canada and the U.S. remains near historic lows. There are currently nearly two jobs available for every person looking for work in the U.S. and this is one of the things central banks are trying to address. They don’t necessarily want people to lose their jobs, but they do want to bring back a balance of job openings and people looking for work to calm wages growth. Can they do this without causing a recession? Feasible, but unlikely in my opinion. I would add that not all recessions have the same severity and that a shallower recession than the last ones we have experienced is definitely in the cards. So, recession or not? Your forecast is as good as mine.

U.S. Midterm Elections

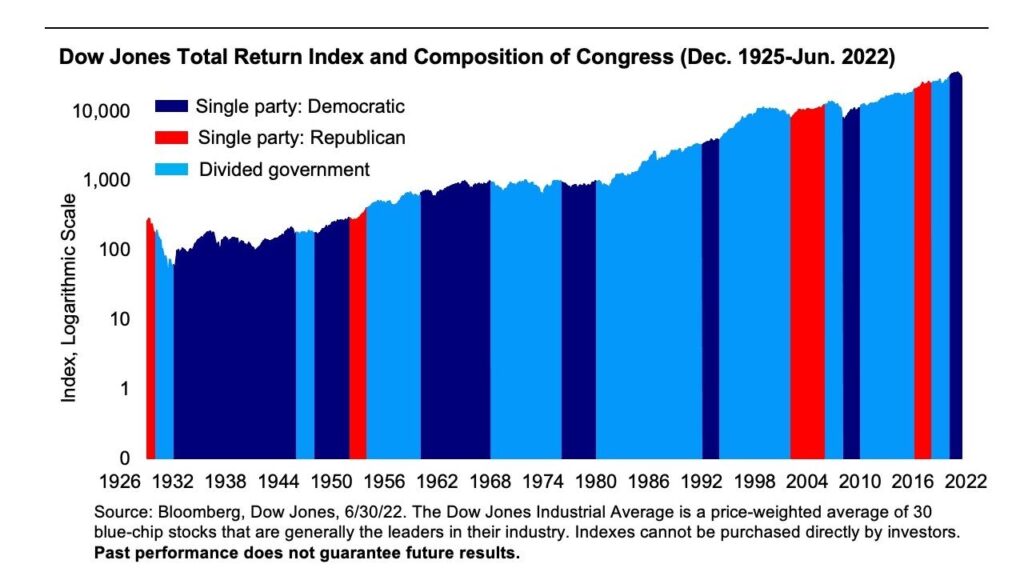

A quick note on the U.S. mid-term elections that are taking place today, November 8, 2022. While a polarizing topic these days, the party in power has historically had little influence on the stock markets. In the past, the party of the incumbent president has had more difficulty in mid-term elections. The Democrats currently hold the House of Representatives and the Senate, but it would not be surprising to see the Republicans take back one or even both houses. Regardless of the outcome, while it may bring short-term volatility, long-term impacts should be moderate.

Please feel free to share your opinions/comments.