The year started out strong with inflation expectations down and the hope that the U.S. Federal Reserve may have finished its job of raising interest rates. That same hope quickly evaporated when new inflation data came out, suggesting that inflation was more persistent than expected and bringing fear of future monetary tightening ahead. Finally, we had two of the largest bank failures in U.S. history and the collapse of a Swiss bank that had been in existence for over 100 years.

Despite all the negative news that is making the headlines, you may be surprised to learn that the stock markets were positive in the first quarter. In fact, they were positive for the 2nd consecutive quarter if you go back to the last quarter of 2022. As you’ve heard me say many times now, I don’t have a crystal ball to tell you where the next few months will go and whether this rally will be sustained. What I do know for sure is that very few people expected a good start to the year and that is what we got anyway. Short-term market predictions are a dime a dozen, and they get a lot of attention (especially when negative). Yet, the vast majority of people invest for the long term, and it has been proven time and time again that trying to “time” the market, i.e. trying to get in and out of the market “at the right time”, is one of the worst strategies an investor can adopt. So, will the market be positive next quarter? You tell me.

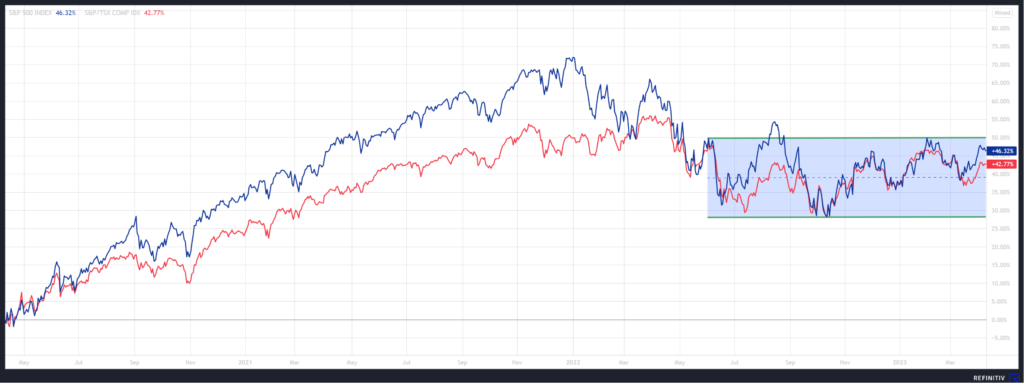

Going back further, someone looking at their statement today for the first time since last summer (June 1, 2022) would probably find the value virtually unchanged. On the other hand, someone who looked at their account every day over the same period would not have had the same experience at all since the market movements during that time were very large. If they had checked their account daily, they would have witnessed several variations of more than 10%, both up and down. This shows that sometimes the famous advice not to look at your investment account every day during volatile periods remains relevant.

As shown in the previous chart, the market has been looking for direction for several months now; which is not unusual during periods of economic uncertainty. With the number of events that have taken place recently, the uncertainty is high, but it is starting to dissipate little by little and this is what will help the markets set the stage for the next cycle.

Banking Crisis

As with 2022, inflation and recession were in the spotlight in the first quarter of 2023. The banking crisis on the other end has been added to the list of major events impacting the markets over the past 15-18 months.

In a nutshell, the banking crisis began when, in early March, Silicon Valley Bank (SVB) attempted and failed to raise new capital. This failure sent a very negative message about SVB and its financial health. Panic ensued and on Thursday, March 9, 2023, the bank’s customers withdrew US$42 billion in a single day. The technological environment that allows us today to open accounts and transfer our money from one institution to another in a very short time certainly helped to accelerate the bank’s downfall, since such large withdrawals in a single day from the same institution would not have been possible just a few years ago. When the panic started to spread, it spread like wildfire.

Now, why was Silicon Valley Bank’s financial health precarious? The investment boom into new technology companies, SVB’s primary customer base, during the pandemic led to a huge increase in the amount of money these companies deposited in their bank accounts at the bank. At the same time, interest rates were at rock bottom as central banks had reduced them to support the economy during the pandemic. SVB, having to invest the large deposits they were receiving from their clients, decided to invest them in longer maturity bonds in an attempt to get a slightly higher return on these deposits. As you now know, these longer-term bonds are also more sensitive to interest rate movements and these interest rates have risen very significantly in 2022; resulting in a substantial decline in the value of the bonds held by SVB. Generally speaking, these declines in themselves would not have had such a significant impact on the bank since they are only theoretical. In fact, by holding the bonds until maturity, SVB would have recouped this decline in addition to having continued to collect their interest payments each year. However, they were not able to hold these bonds to maturity as the large withdrawal requests forced them to sell bonds earlier and realize a loss. On top of that, SVB’s target customer base was not getting as many deposits in 2022 as they had in 2020 and 2021. New technology companies were more in “withdrawal” mode than in “deposit” mode last year, adding to the bank’s troubles.

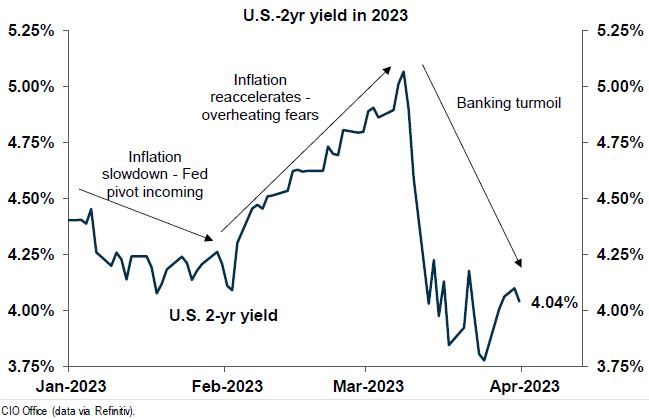

Government authorities reacted quickly by putting in place new measures to prevent the fear from spreading to the banking system in general, which could have led to much greater consequences. Nevertheless, banks worldwide were put under the microscope and felt the impact. Fears did spread to other institutions, forcing the closure of Signature Bank in New York and the purchase of Credit Suisse by its competitor, UBS. All of this volatility also translated into very strong movements in interest rates, as shown in the chart below illustrating the evolution of the US 2-year rate since the beginning of the year.

For now, it appears that the contagion is limited and that the major problems have been fixed, but that does not mean that others will never be impacted. There are about 4,700 institutions covered by the FDIC in the U.S. versus only 85 covered by CDIC in Canada. Our banking systems are fundamentally different, I think you’ll agree. Interestingly enough, North Dakota, a U.S. state with a population of less than 800,000, has more banks than all of Canada (Bloomberg).

Conclusion

In conclusion, after a busy, but overall good first quarter when looking at portfolio returns, we have a lot to watch in the coming quarters. Recent inflation data seems to be pointing in the right direction although it remains fragile. The economy is strong, but cracks seem to be appearing and some sectors such as technology may have already experienced their recession. The aftershocks and impacts of the banking crisis also remain to be fully seen because it would not be surprising to see financial institutions tighten their credit conditions and reduce the volume of loans they make to their individual and commercial clients. Such a tightening could have an impact on financial conditions and act similarly to an interest rate hike; perhaps allowing the U.S. Federal Reserve to take a pause in its interest rate hikes.

Do not hesitate to contact us if you have any questions or would like to discuss this further.

This information was prepared by Mathieu Garand who is an investment advisor for iA Private Wealth Management Inc. and does not necessarily reflect the opinion of iA Private Wealth Management Inc. The information contained in this newsletter has been obtained from sources believed to be reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on analysis and interpretation as of the date of publication and are subject to change without notice. In addition, they do not constitute an offer or solicitation to buy or sell the securities mentioned. The information contained herein may not be suitable for all types of investors. The Investment Advisor may only open accounts in provinces where it is registered. iA Private Wealth Management Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth Management is a trademark and other name under which iA Private Wealth Management Inc. operates.