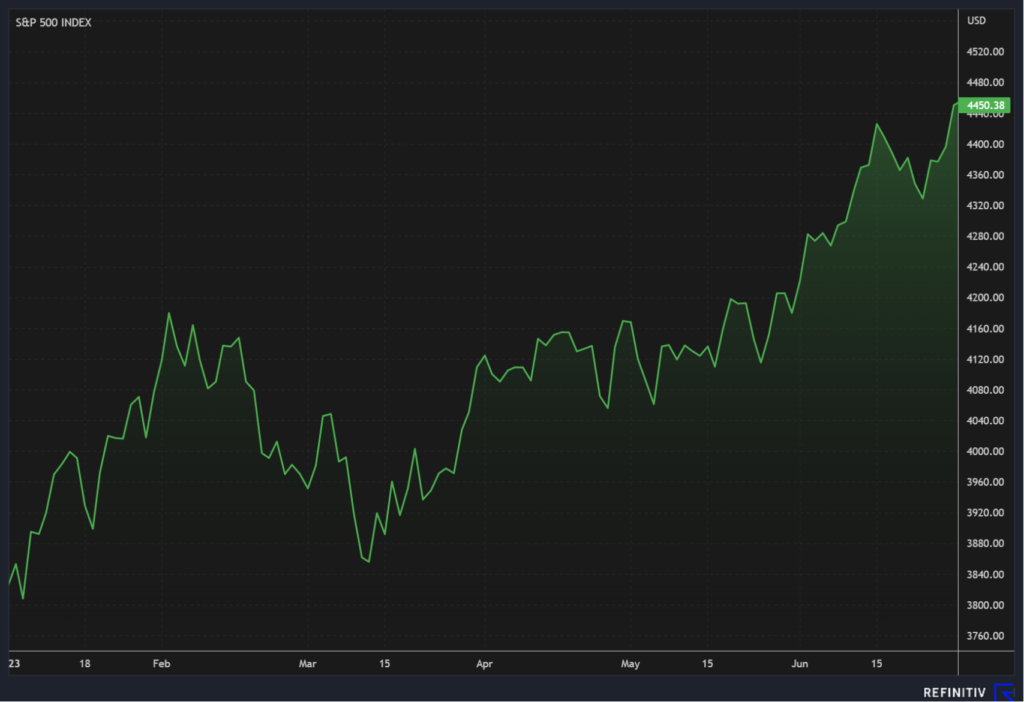

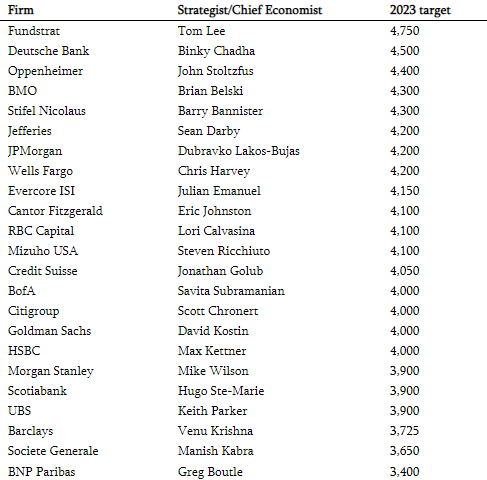

Ultimately, we just had a very strong first half to 2023. Looking at these results serves as an excellent reminder that no one can predict the direction of the markets with accuracy, and that it’s a dangerous game to try to do so. When we looked at the forecasts of Wall Street strategists and economists at the end of 2022, many were predicting a difficult first half of the year and a recovery in the latter half. JP Morgan, America’s largest bank, predicted a return to the 2022 lows in the first half of the year, before seeing a recovery in the final 6 months. Bank of America, the 2nd largest US bank, also predicted a difficult first half to the year, before seeing a rebound in the second half. (Source) Closer to home, François Trahan declared on November 11, 2022 that “the economic apocalypse” was upon us. Yet the US stock market is up 11.46% between November 11, 2022 and June 30, 2023. Finally, the S&P 500, which includes the 500 largest companies in the US, closed the first half of the year at 4450. For reference, here are the aforementioned forecasts of the level at which the US stock market would end 2023, according to strategists at 23 of the world’s largest financial institutions. These forecasts were made at the end of last year.

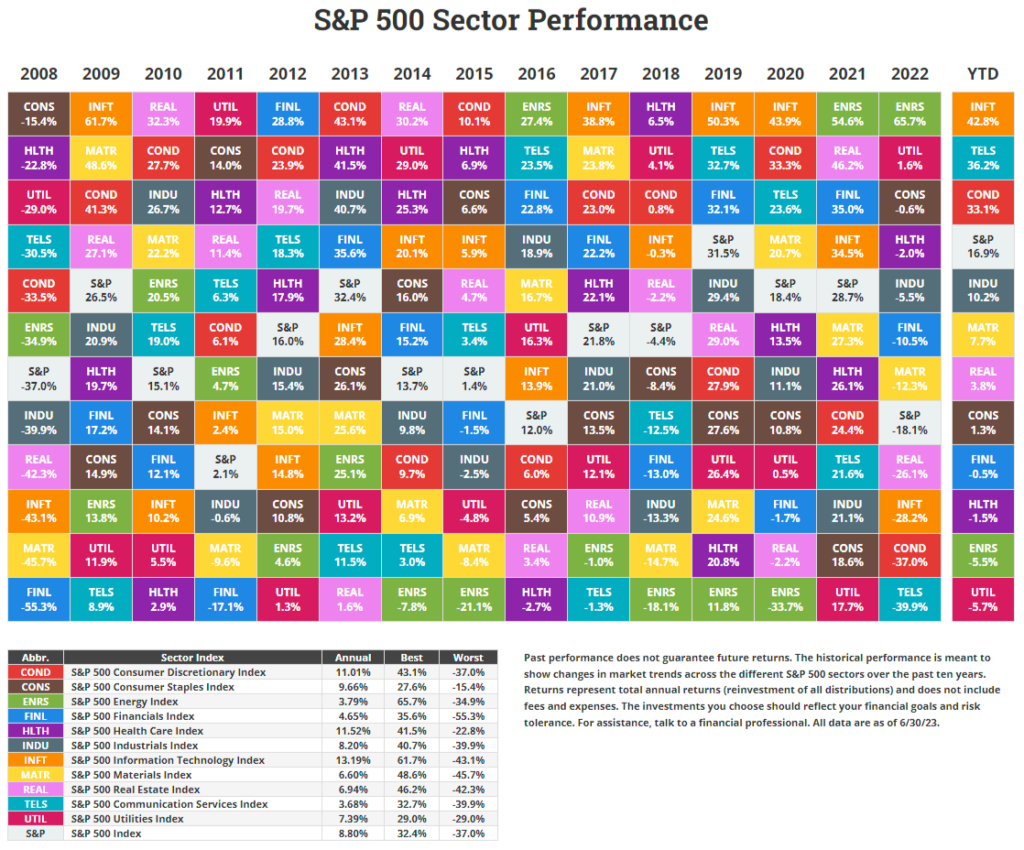

Having said that, even though we’ve had good returns for some time now, that doesn’t mean everything is behind us. There’s still a lot of uncertainty surrounding the economy, and I think it’s wise to remain cautious over the coming months. The markets are very optimistic, and only time will tell whether they are right to be so. Good diversification remains the key. It’s often said, but good diversification with a long-term investment horizon is the best approach. The table below shows that the best-performing sectors vary considerably from year to year. You’ll also notice that the sectors that perform worst in one period are frequently the best performers in the next. We have another good example of this so far this year: the three best-performing sectors between January 1 and June 30, 2023 are also those that performed the worst in 2022 (communications services, information technology and consumer discretionary).

Interest rates

We’ve been talking about interest rates for almost 18 months now, and they’re still at the center of economic and financial news. The effects of the central banks’ aggressive rate hikes since last year are starting to be felt more and more by consumers, but the economy is still running strong. The ideal “soft landing” scenario that central banks are aiming for seemed unlikely just a few months ago, but the odds in its favor seem to have increased of late with inflation slowing in a resilient economy. The Bank of Canada recently raised its rate by a further 0.25% to 5%; the FED in the US is likely to do the same later this month.

Year-to-date performance

You may have heard that the U.S. stock market’s strong performance to start the year was mainly due to a few large companies that were single-handedly pulling the market up. They’ve even been dubbed the “Magnificient 7”: Alphabet (Google), Apple, Meta Platforms (Facebook), Microsoft, Amazon, Nvidia and Tesla. This was true mainly up to May, but the rebound spread to the rest of the markets in June. There is now more depth to the recovery. At the end of May, the Magnificient 7 were up 49.7% year-to-date, while the other 493 companies in the S&P 500 were down 1.1%. Many companies did not participate in the market rally, but the recovery has since become more widespread. At the end of June, the 7 major tech companies were up 52%; but the 493 others were now up 5.1% year-to-date. Historically, this has been a good sign when more companies start to participate in the rebound.

If you have any questions or would like to discuss this further, please do not hesitate to contact us.

This information was prepared by Mathieu Garand who is an investment advisor for iA Private Wealth Management Inc. and does not necessarily reflect the opinion of iA Private Wealth Management Inc. The information contained in this newsletter has been obtained from sources believed to be reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on analysis and interpretation as of the date of publication and are subject to change without notice. In addition, they do not constitute an offer or solicitation to buy or sell the securities mentioned. The information contained herein may not be suitable for all types of investors. The Investment Advisor may only open accounts in provinces where it is registered. iA Private Wealth Management Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth Management is a trademark and other name under which iA Private Wealth Management Inc. operates.