Several factors influence these results. As I mentioned in my Q2 2023 commentary (see here), the markets had an excellent first half of the year, despite the rather negative predictions of the various strategists at the world’s major institutions towards the end of 2022. Nonetheless, I suggested we remain cautious, given the uncertainty that hovered (and still hovers) over the global economy. The markets were very optimistic, perhaps too optimistic, on the news, and the last few months have brought them back down to earth, so to speak.

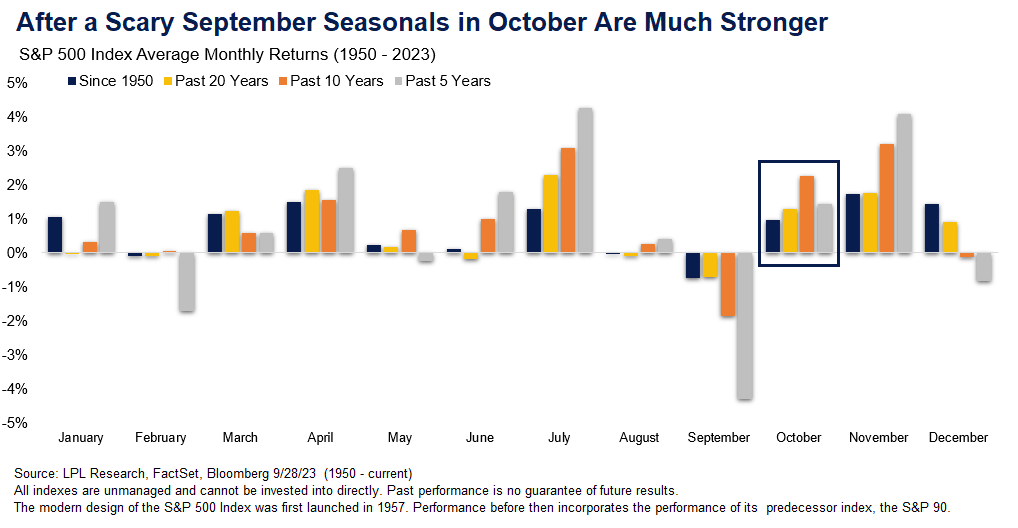

There is also a certain seasonal effect on stock markets. Looking back over the years, the U.S. stock market, represented by the S&P 500 (the index of the 500 largest companies in the U.S.), often takes a turn for the worse in September. There’s really no precise factor that defines why this is the case, but when you look back over 70 years of history, you realize that, on average, September has delivered negative returns. There are a number of theories on the subject, including a mix between the return to work after the summer vacations, the start of school, tax transactions before the end of the quarter, or even the fact that people try to anticipate the “September effect” as reasons that could explain this seasonality. Now, why not simply sell your investments before September and reinvest in October? Sounds like a simple idea; but when you look at the data, since there’s nothing specific to explain this negative average, you also realize that some September months produced very strong returns.

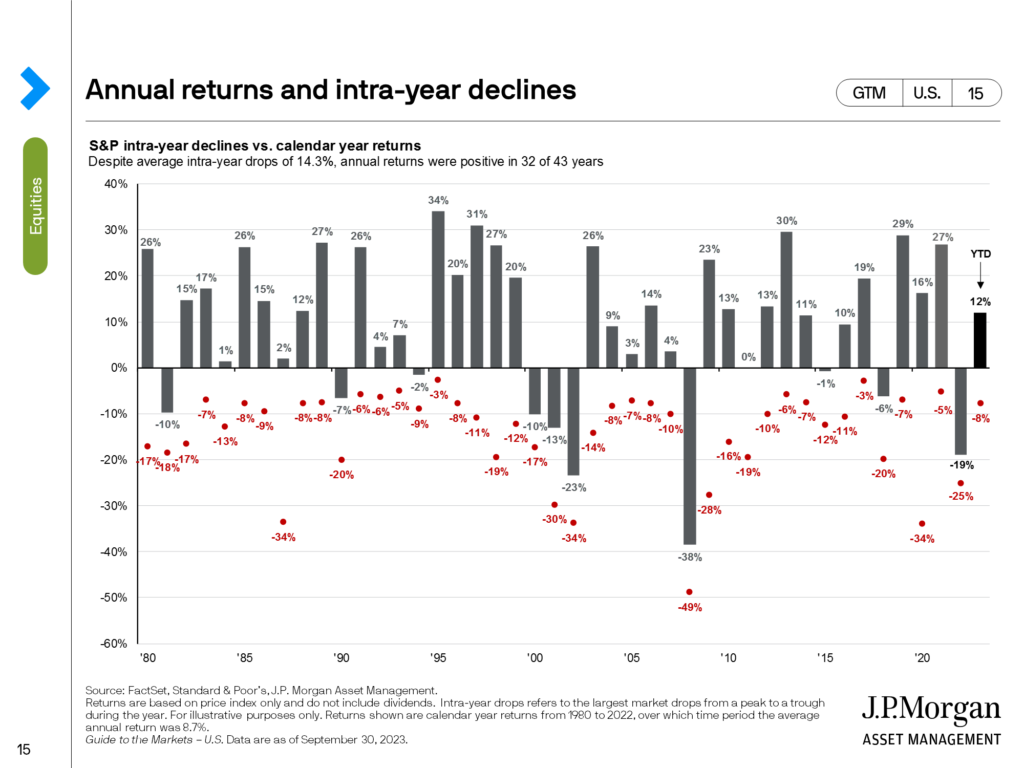

Now, after such a good start to the year, it’s not abnormal either to see a pullback like we’ve just experienced in Q3. Historically, in a normal calendar year, the S&P 500 averages a 14.3% decline within the year. This has not prevented the index from delivering a positive return in 32 of the last 43 years, with an average return of 8.7%/year over the same period. So far this year, the maximum decline in the S&P 500 has been around -8%, yet the index remains positive year-to-date.

Interest rates

Interest rates have continued to feature prominently in conversations over the past two years, and the last few months have been no exception. Inflation figures continue to be closely monitored every month, as central banks attempt to assess the impact their aggressive rate hikes will have on their respective economies. As we all know, interest rate hikes take time before they are fully reflected in the economy. For example, the Canadian economy is much more sensitive to interest rate hikes than the US economy. There are a number of reasons for this different sensitivity, but one of the main ones is real estate, which accounts for around twice as much of our total economy in Canada compared with the United States. The mortgage structure is also very different with our renewable mortgages in Canada compared with the vast majority of mortgages issued in the United States, which are 30-year fixed-rate mortgages. What’s more, we’re seeing more evidence of the impact of rate hikes on the Canadian economy than on the U.S. economy to date. It’s hard to say where rates will go from here, but markets seem to be increasingly accepting the fact that interest rates will stay higher, for longer, to fight inflation.

Alarmist forecasts

I’d like to finish by talking about a subject that affects many people: the alarmist forecasts that are constantly being published in the media, because those are the ones that attract the most interest. Many “strategists” or “forecasters” have made a career out of predicting an imminent “crash”, recession, etc.; but it’s also interesting to note that these people often predict a catastrophe or “economic apocalypse” virtually every year. They’re bound to be right in the end, even if it takes years. If I predict it will rain tomorrow every day, I can promise you I’ll end up being right. Peter Lynch, who is widely regarded as one of the most prolific investors of all time, once said ( and rightly so), “Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” There will always be reasons not to invest, just as there always have been; and yet, the financial markets have continued to rise in spite of it all.

For the next few months, inflation and interest rates will remain under the microscope. We are currently entering a new earnings season, which should tell us more about the health of companies and the real impact of all the new economic data on them.

If you have any questions or would like to discuss this further, please do not hesitate to contact us.

This information was prepared by Mathieu Garand who is an investment advisor for iA Private Wealth Management Inc. and does not necessarily reflect the opinion of iA Private Wealth Management Inc. The information contained in this newsletter has been obtained from sources believed to be reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on analysis and interpretation as of the date of publication and are subject to change without notice. In addition, they do not constitute an offer or solicitation to buy or sell the securities mentioned. The information contained herein may not be suitable for all types of investors. The Investment Advisor may only open accounts in provinces where it is registered. iA Private Wealth Management Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. iA Private Wealth Management is a trademark and other name under which iA Private Wealth Management Inc. operates.