August was off to a great start, continuing a trend that began around mid-June. The tide finally turned at the end of the month during a speech by Jerome Powell, chairman of the board of the US Federal Reserve (FED), at the Jackson Hole Economic Symposium. The FED is the institution that dictates, among other things, decisions on interest rates and monetary policies in the United States. During his speech, Powell mentioned that the United States will need tight monetary policy for some time before inflation is under control, which could translate into lower growth, a weaker job market and some difficulties for households and businesses.

Nothing too surprising here you might say, but as I mentioned in my July comment, the rise in the markets during the month was partly due to interest rates that had fallen in anticipation of a pivot from the FED regarding interest rates. However, Powell’s comment went against this movement by presaging higher interest rates for longer. Those comments therefore caused interest rates to rise sharply and stocks and bonds to fall in tandem. A scenario we have unfortunately known all too well this year. Although North American markets had been positive since the beginning of the month before his speech on August 26, they ended the month in negative territory.

Now, what can we expect going forward?

At the risk of boring you by repeating the same story, you already know the risks to watch for in the coming months. Inflation, interest rates and the economy remain the hot topics that will impact markets the most over the coming months. There is still a lot of risk for the markets at the moment and the very strong rise between mid-June and mid-August was very fast, probably a little too much.

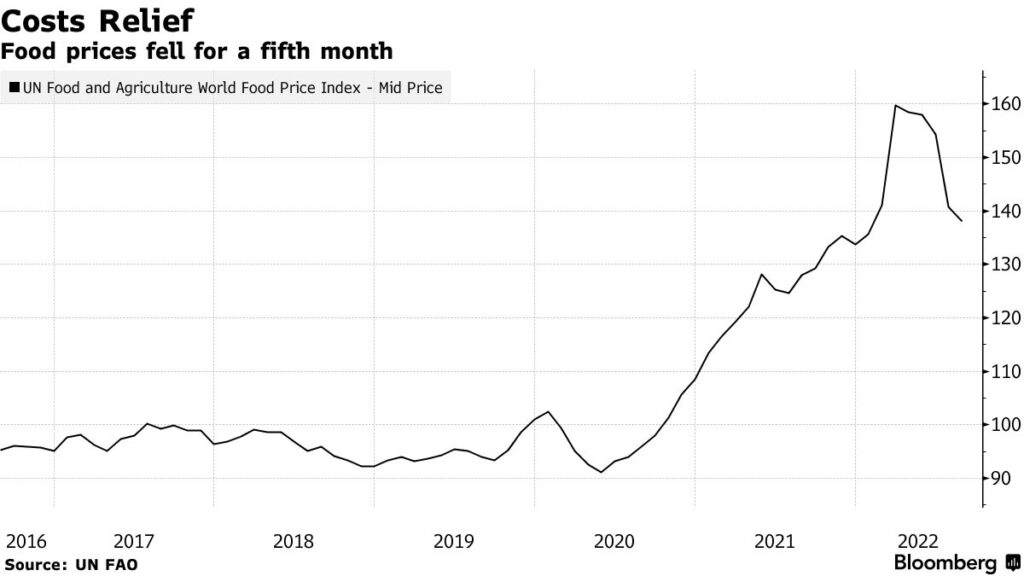

- Inflation: As mentioned in my last comments, there are still signs of encouraging trends about inflation. The figures released in August for inflation in July continued their downward trajectory. Global food prices were also down for a 5th consecutive month, although they remained high. Oil prices also continued their descent for a third month in a row (although it seems gas stations are taking more time to lower prices than to raise them).

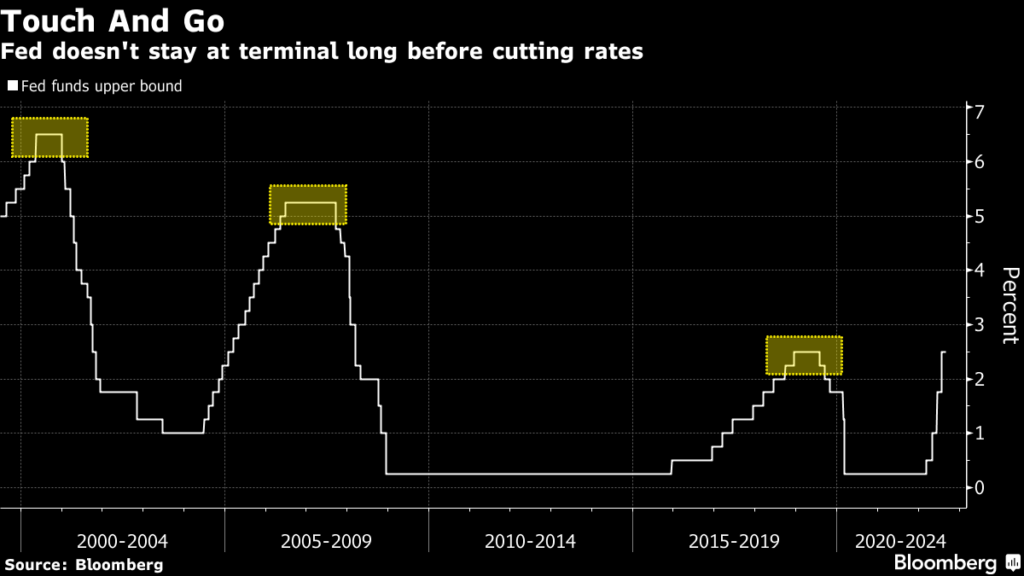

- Interest rates: Following the Fed Chairman’s comments, interest rates rose sharply. Future interest rate expectations also, to reflect Powell’s view of higher rates for longer. Is this drastic movement sustainable over an extended period, that is the question. If we look at the last three cycles of rate hikes since the end of the 1990s, we quickly realize that terminal rates have never remained in place for long before falling. This theory was one of the bases of the recent rise in the markets and which was called into question following the Jackson Hole conference.

- Economy: North American economies remain in good health, despite some cracks starting to appear. Unemployment rates remain near historic lows, companies continue to invest and hire, consumer sentiment improved slightly last month and the financial health of consumers on both sides of the border remains very good. According to a recent CIBC study, one-third of Canadian households have no debt. Admittedly, we are seeing the real estate markets slow down considerably, both in Canada and in the United States, given the new higher interest rates. This slowdown should also continue and lead to a drop in real estate prices, but we must not forget that for the majority of people, this drop will only be on paper since they have not used the added value on their property in recent years.

As mentioned last month, this is a very special time when good news for the economy can be bad news for inflation and bad news for the economy can be good for inflation. In this environment, good news on the economy is welcome as long as it is not “too” good. For inflation, very good news, as long as it does not come at the expense of very bad news for the economy, would be welcome. If inflation was to come down faster than expected without doing too much damage to the health of consumers and businesses, we should have a favorable environment.

For the month of September, we will be closely watching the Bank of Canada’s interest rate decisions, scheduled for September 7 and where a 0.75% hike is widely expected, and the Fed’s decision, scheduled for September 21 and where a rise of 0.75% is expected at the moment. However, the Fed’s decision could be impacted by new data that will come out before the 21st.

In closing, here is a quote from Warren Buffett (often considered the most accomplished investor of all time) that makes me laugh, as much for its imagery than for its relevance: “Successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time: you can’t produce a baby in one month by getting nine women pregnant.”

As always, I appreciate your comments and questions so please don’t hesitate.