Following “Liberation Day” in the United States, we thought it would be a good time to take stock of the current situation and, unfortunately, to revisit some basic investment principles. While you are likely familiar with them, it is always helpful to review these concepts—especially during volatile times like the one we are experiencing now.

On April 2, 2025, the Trump administration announced a series of “reciprocal” tariffs of at least 10% on imports from more than 180 countries, including territories with no permanent population or Antarctic islands inhabited by penguins (source).

This announcement had an immediate impact on global markets, as investors feared retaliatory measures from affected countries, potentially leading to a global trade war.

Since taking office on January 20, the new U.S. president has issued a near-daily stream of executive orders and announcements, ranging from banning paper straws to renaming the Gulf of Mexico and a mountain in Alaska, to imposing various tariffs. He has also frequently backtracked on several of these tariff announcements, using them more as negotiation tactics than genuine economic measures.

It is still too early to determine whether these reciprocal tariffs will remain in place over the long term or if some will eventually be rolled back. Although White House representatives have stated the tariffs are non-negotiable, the president himself contradicted this on March 3 by stating they were, in fact, open to negotiation. (source)

Investment Perspective

From a wealth management standpoint, we continue to maintain a long-term perspective despite recent volatility. We do not believe it is advisable to adjust portfolios in response to every announcement, as they are likely to shift quickly and frequently. Such adjustments may actually cause more harm than good, especially given the current unpredictability of the U.S. administration.

As in past periods of market volatility, we believe it is best to ride out the storm, knowing that our portfolios are well diversified across different asset classes, investment styles, geographic regions, and, most importantly, aligned with your personal goals as defined in your financial plan.

Don’t Confuse Market Indices with Your Portfolio

It’s also important to remember that the market returns highlighted in daily news—morning, noon, and night—typically reflect only equity indices. These do not represent the performance of a well-diversified portfolio that includes equities, bonds, structured products, and alternative investments—such as the ones we implement. Such diversification significantly reduces the impact of volatility emphasized in the media.

A Vital Reminder: Volatility Is Part of the Journey

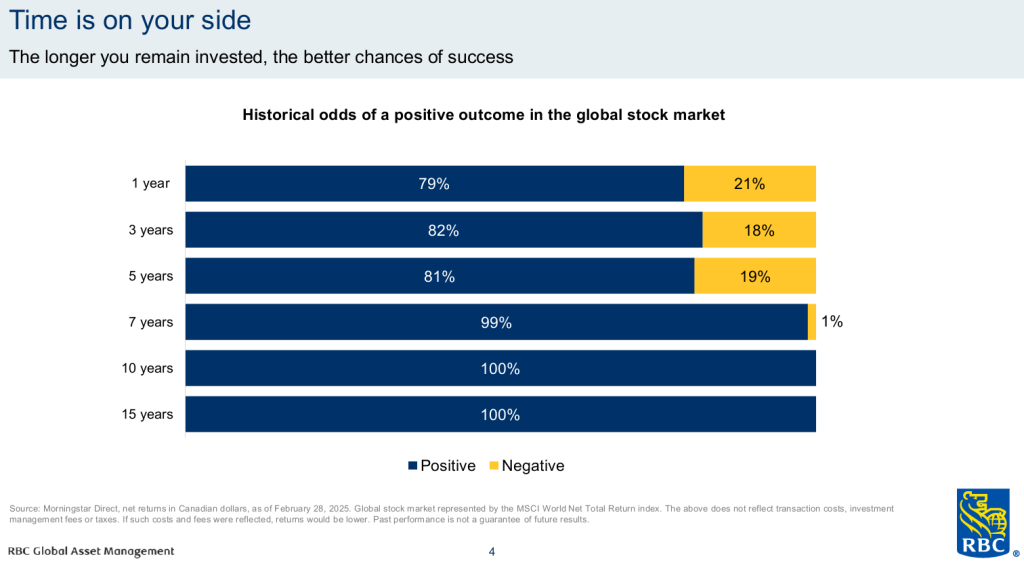

Market downturns and periods of volatility are never pleasant, but they are a normal part of the investment journey. They represent the price we pay for achieving strong long-term returns. The key is to stay focused on long-term goals and to have the patience and discipline to let the markets settle.

Recent history illustrates this well: consider the COVID-related market drop in 2020 or the decline in inflation and interest rates in 2022. These periods were followed by significant rebounds, underscoring the importance of staying invested.

Useful Visual Reminders During Volatile Periods:

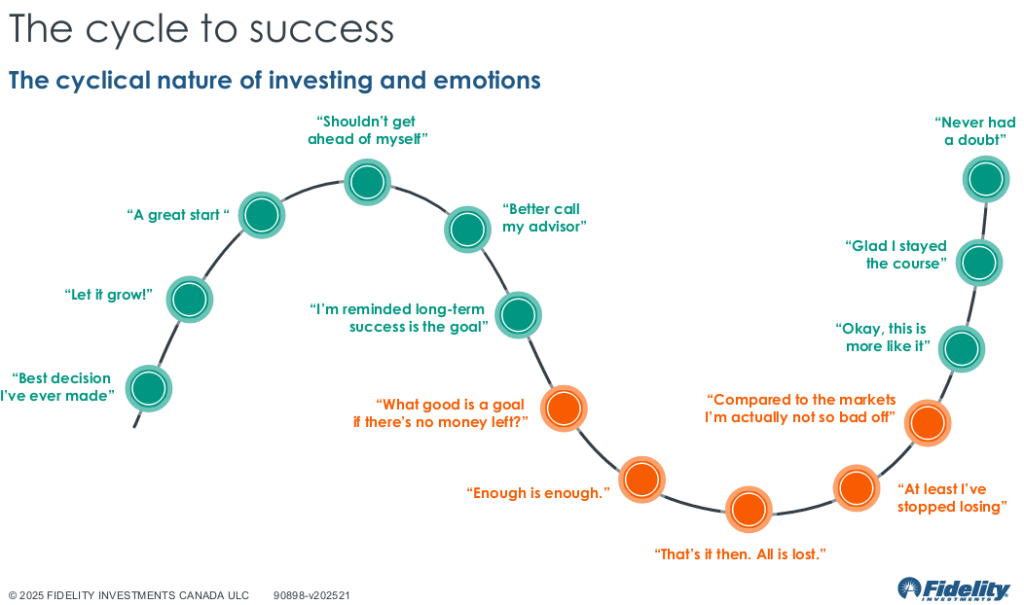

Investor Emotion Cycle

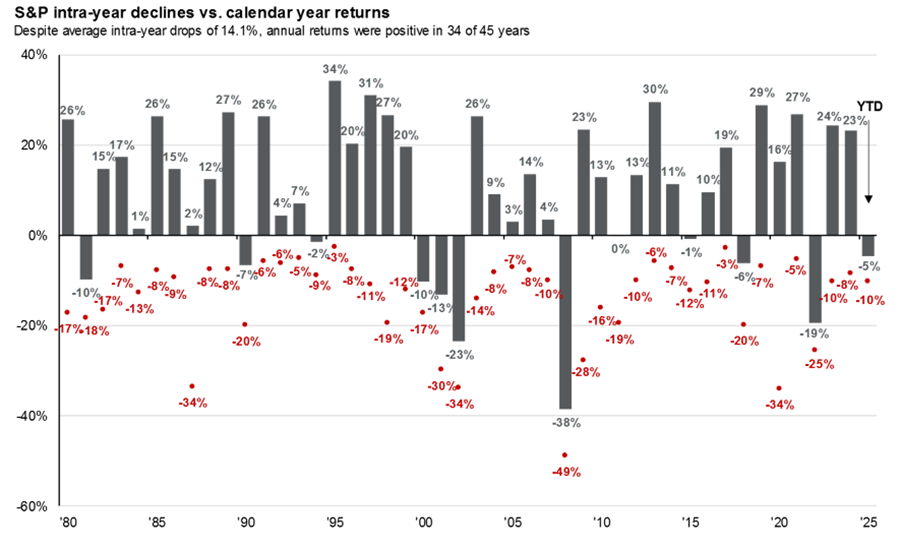

Since the 1980s, the U.S. stock market has averaged a 14% intra-year decline, yet annual returns have been positive in 34 of the last 45 years.

There will always be bad news. But over the long term, market performance tends to recover.

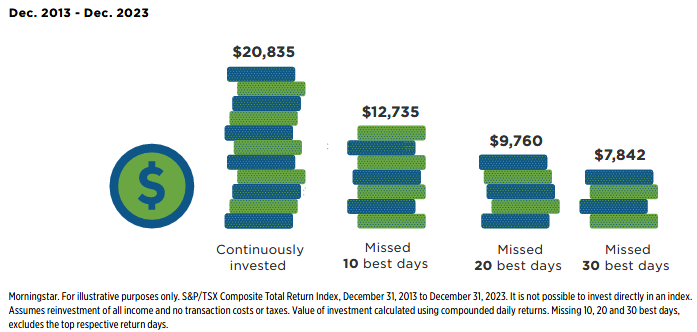

The importance of staying invested: missing just the best days on a $10,000 investment can make a significant difference.

This information has been prepared by Mathieu Garand who is an investment advisor at iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The investment advisor can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.