In these tougher times for the stock markets, I find it important to write more frequent commentaries to keep you informed and updated. I will try not to expand too much, but sometimes turns out to be more difficult than I thought.

May 2022

The excellent end to the month was mainly based on the expectation that the worst of inflation was behind us and that this would allow central banks to not have to be more aggressive with their interest rate hikes. We are currently juggling with a high level of uncertainty with many things happening at the same time. Whether it’s soaring inflation, interest rate hikes, oil prices, the war in Ukraine, tight monetary policies or slowing economies, everything is interrelated and there are many factors to watch. It is important to understand that for the tide to turn in the markets, we don’t need all these factors to settle; rather, there needs to be more clarity that would demonstrate progress in the right direction. Markets are always looking far ahead, and uncertainty is the biggest enemy, often more so than the problems themselves.

Inflation

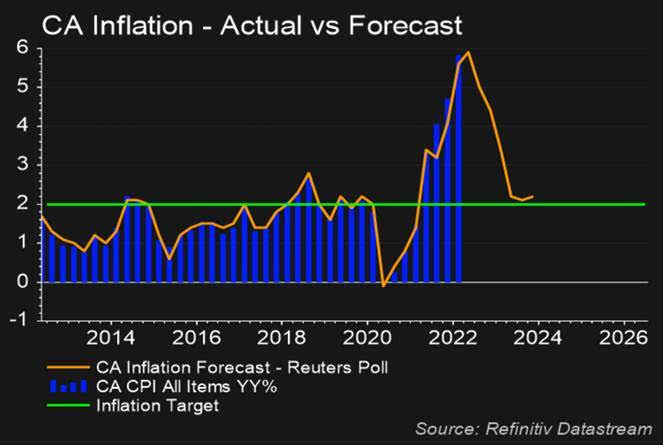

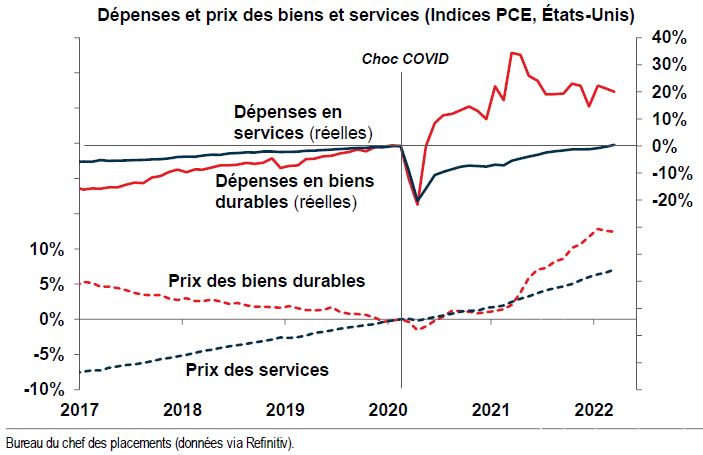

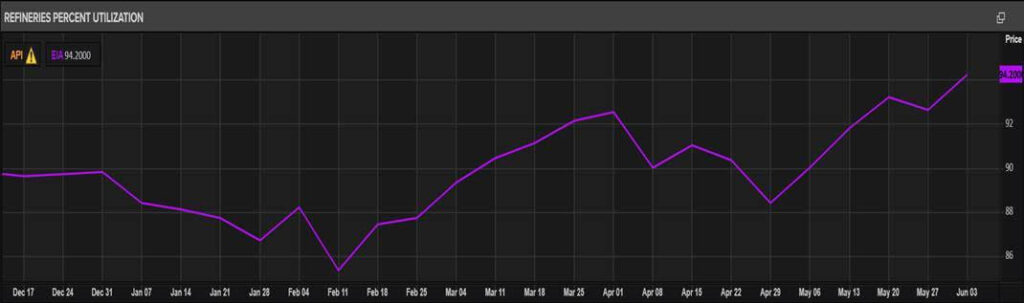

Despite all the pessimism dominating the headlines these days, there is still some positive. Falling inflation expectations, declining demand for goods and increasing demand for services, increased capacity utilization at refineries and fewer job openings are just a few examples of factors which could have a positive impact to help reduce inflation (see graphs at the end for those interested).

It is impossible to know in advance what will or will not materialize. Will higher gas prices cause people to travel less, especially in the summer months when demand is historically higher? Lower demand would eventually lead to lower oil prices, which would help lower inflation. Could the return to equilibrium between demand for goods, which was up sharply during covid, and services, which was down sharply during covid, also help bring inflation down since less demand for goods would give supply chains a chance to gradually regain the upper hand? Could the drop in job openings, if it continues, help reduce wage growth that is also fueling inflation? Lots of unknowns that we will have more clarity on as the year progresses. We will have to be patient.

Fixed income

As discussed in previous commentaries, the fixed income market had a very difficult start to the year following drastic and rapid increases in interest rates. As a result, the traditionally more stable portion of portfolios that usually somewhat acts as an “insurance policy” when markets are more volatile has not served its purpose this year. A positive sign in May was a trend towards more normal behavior for bonds. This is an encouraging sign that bonds will gradually be able to resume their role as portfolio protection in the future. The outlook for the next 12 months is also much better than that of the last 12 for this asset class.

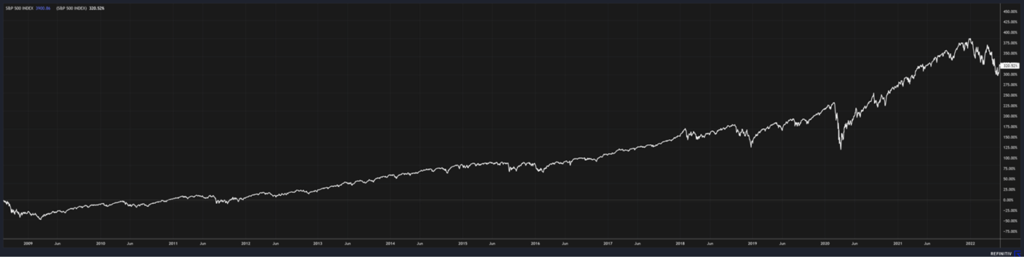

Time in the market vs timing the market

In conclusion, it is essential to understand that to have long-term success in the financial markets, it is the time in the market that counts, not timing the market. The distinction is very important because in the short term, the time when you invest will influence the return more, but in the medium/long term, it will no longer matter. Let’s take the example of an investor who would have invested all his money on the US stock market, represented by the S&P500 index, on August 28, 2008. You could argue he’s the unluckiest investor, and in the short term, you would be right. At the bottom of the financial crisis about 6 months later, on March 9, 2009, his investment would have declined about 47% (note the use of decline, not lost). This means that in just 6 months, his $100,000 investment would have gone down to $52,853. It would have been quite difficult at that time to take a step back and think long term, but let’s say the investor does and decides not to touch anything. Today, that same $100,000 invested on August 28, 2008 in the S&P500 would be worth $420,520 (as of May 31, 2022) for a total return of 320.5% or 11%/year (data calculated with Refinitiv Workspace and Morningstar). A result all the more interesting when you consider he went through the great financial crisis of 2008, the “flash crash” of 2010, the American debt crisis of 2011, the occupation of Crimea by Russia in 2014 , the oil crisis of 2015, the Brexit, the missile crisis with North Korea between 2017 and 2018, the trade war with China in 2018, the Covid in 2020 and the current decline of 2022. In short, the lesson to be learned here is that there will always be reasons to be negative in the short term, but it won’t matter in the long run.

I believe we are not done with volatility and we will see more in the upcoming weeks/months. Currently, it is very easy to find dissenting opinions from very senior people in the largest institutions in the world; some say the worst is behind us, while others say it is not over. The lesson here is that no one will know when the worst is over until it is, and neither will I. On the other hand, what I know for a fact is that the tide will eventually turn. Will it be in a week, in a month or in three months? No one knows. But as mentioned earlier, timing will not matter when looking at these events in the future. In the meantime, we continue to monitor the positions in your portfolios and if we are still confident that these positions will perform well in the future and that they still have good growth potential, we let the storm pass and we stick with them since it is the best thing to do.

Things to watch for in June:

• June 1: Bank of Canada’s decision on interest rates (0.50% increase expected and confirmed)

• June 10: US inflation data (8.3% year-on-year rise expected, 8.6% year-on-year rise confirmed)

• June 15: US Central Bank’s decision on interest rates (0.50% increase expected)

• June 22: Inflation data in Canada

• June 29: Core PCE data on inflation in the United States: The favorite measure of the Fed (US Central Bank) to monitor the real impact of inflation

Hoping you appreciated this commentary (which again ended up being quite long).

Please feel free to send me your questions or comments.

Interesting charts