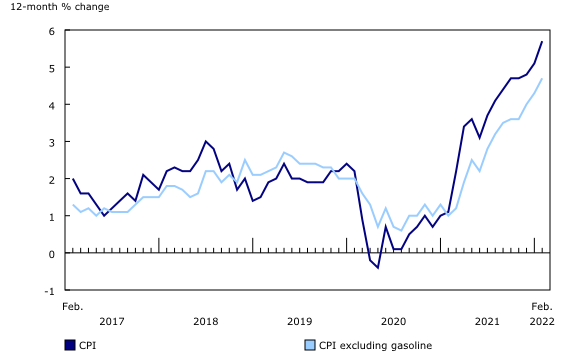

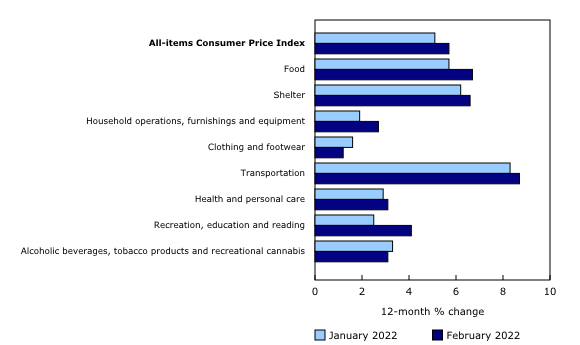

To start 2022, we were at the top of the Omicron variant “wave”, the financial markets had been on a roller coaster ride since the end of 2021 and all eyes were now on inflation, the answers from central banks and what they would (or would not) do to calm rising consumer prices. Inflation reached 5.7% year-over-year in February 2022 according to Statistics Canada; and although price increases are widespread across all sectors, the price of gasoline has a lot to do with it as the increase, excluding gasoline prices, was rather 4.7% over twelve months. These price increases, due in part to the reopening of economies around the world, supply chain issues, staffing shortages and pent-up demand during lockdowns, are well above the Bank of Canada’s long-term inflation target of 2% (range of 1-3%). In an environment like this, central banks often turn to their tool of choice to calm thigs down: interest rates.

1. Comments on market volatility in the first quarter

The objective behind interest rate hikes is simple:

- Increase the cost of consumer debt, which will increase their fixed expenses

- Higher fixed expenses (mortgage, car, credit card, etc.), so less money available for different products and services

- The balance between supply and demand; when demand falls, prices will also fall

Let’s take the example of cars; currently, the inventory of new cars is very low. This leads to :

- Demand for used cars on the rise

- Low supply of used cars since people can’t get a new vehicle, so they don’t switch

- Lots of demand, little supply and rising used vehicle prices

Now consider the same situation, but with higher interest rates. On the demand side, higher interest rates will result in higher payments for the same car, but on top of that, the consumer will have less money available since they already have to more of their budget to cover other expenses. Fewer people will want to switch under these circumstances and the demand for vehicles is reduced. On the supply side, manufacturers continue to produce new vehicles, individuals who have leased vehicles will be able to trade them more easily for new ones and the supply of used vehicles increases. A decrease in demand, in this case coupled with an increase in supply, will cause used car prices to decrease. I agree that this is a greatly simplified scenario, but you get the point.

It is tempting to think that it is simple and that everything will be solved easily with interest rate hikes. However, we must go a little further to understand the reality of the stock market. The stock market always tries, rightly or wrongly, to anticipate the future. Although the scenario of raising rates to calm inflation seems rather simple and effective, it is not without risk. What would happen if central banks raised interest rates too much and too fast? The fear of the financial markets in this case is, and this is by no means a prediction on my part, a recession. How could rate hikes lead to a recession?

- Higher cost of debt for consumers: lower demand for products and services

- Reduced revenues for businesses

- Higher cost of debt for businesses: lower profit margins and cash on hand

- Weaker growth prospects for businesses

- Employee Cuts

This is one of the risks in the markets, but like the others, it is not certain to materialize. Central banks could manage to successfully calm inflation without adversely affecting the economy and this fear was just a storm in a teacup; but it would still have brought volatility to the markets.

This lengthy (yet brief) explanation primarily describes what was driving the markets between late 2021 and early 2022. Unfortunately, for a portfolio made up of traditional equity and fixed income securities, this kind of scenario is negative, in the short term at least, for both sides.

- For equities, uncertainty and fear of adverse events will lead to volatility

- For fixed income, rate hikes will lower the value of bonds since it has an inverse relationship with interest rate movements

Unfortunately, during the first quarter, there were very few places to hide to protect portfolios. Usually, when stocks underperform, bonds compensate and vice versa. With the particular circumstances at the beginning of the year, this was not the case as the two moved in tandem. Quickly on the relationship between bonds and interest rates; say you hold an investment with a return of 3% per year and a new investment with the same risk and the same characteristics becomes available, but the latter will yield 4% per year instead; which would you prefer? Let’s go back to the principle of supply and demand. People who are invested in the 3% investment will want to get out of it and into the 4% investment. New investors will want to go directly to the 4% investment. Therefore, the demand for the 3% investment will be low, which will lower its value today (although the value at maturity will remain the same). This is again oversimplified, but that’s the point. If you had answered that you preferred the 3% investment, call me, we are due for a meeting.

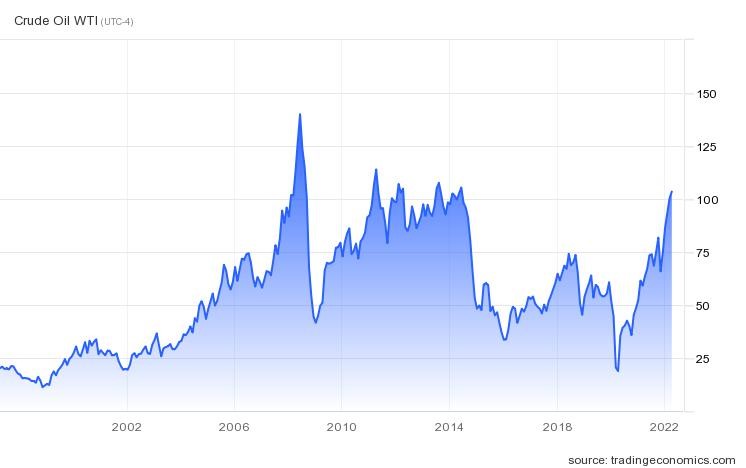

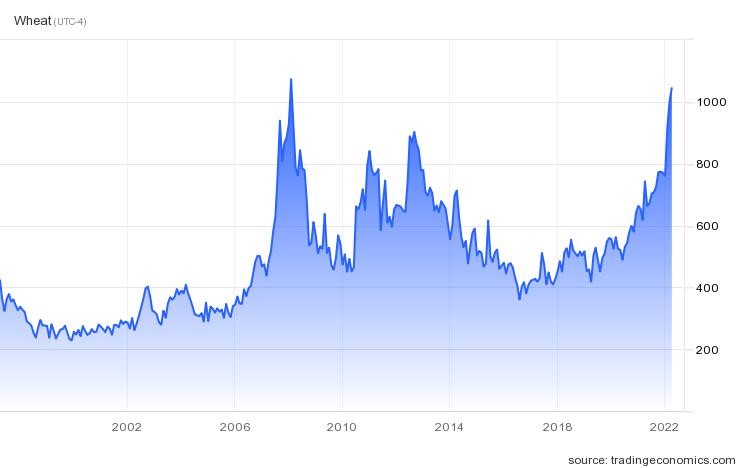

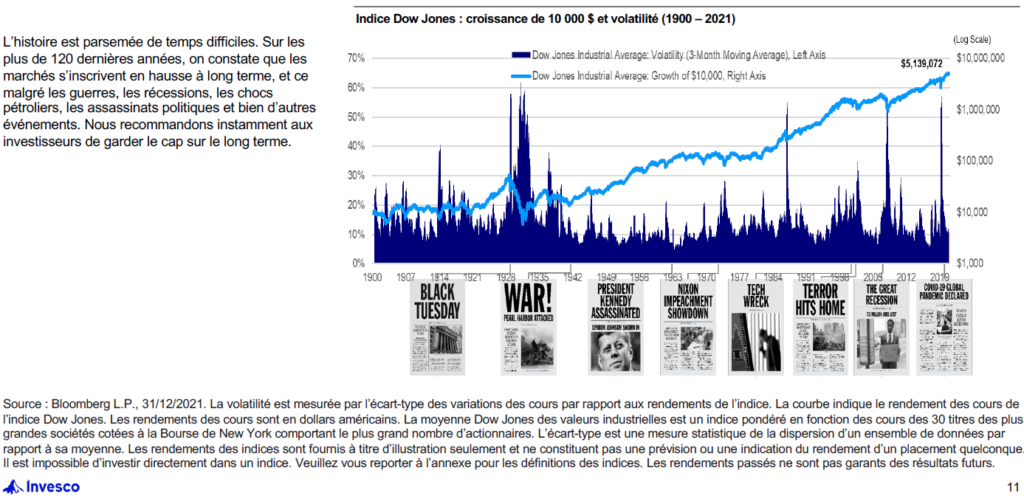

In February, rumors of an imminent Russian invasion of Ukraine were rapidly intensifying. On February 24, Russia begins its invasion of Ukraine. This crisis is still unresolved, but as with many armed conflicts in the past, although they are terrible humanitarian tragedies, the markets tend to be volatile in the short term and then recover. This time was no exception. Markets were volatile before recovering and the focus shifted back to inflation management which now had an additional hurdle in its path. Russia being a major exporter of several key commodities to the world (oil, natural gas, wheat, neon, metals, fertilizers, etc.), while Ukraine exported grain products, metals, etc.; this war further increases fears of persistent or rising inflation and this is what has led to sharp moves in commodities such as oil and wheat among others (see charts below).

2. Outlook for the coming months

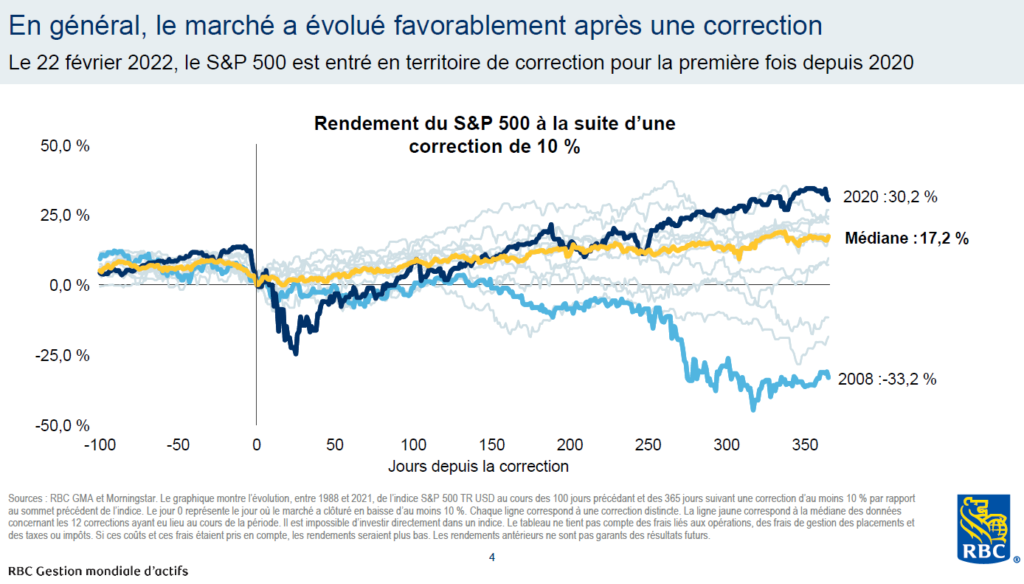

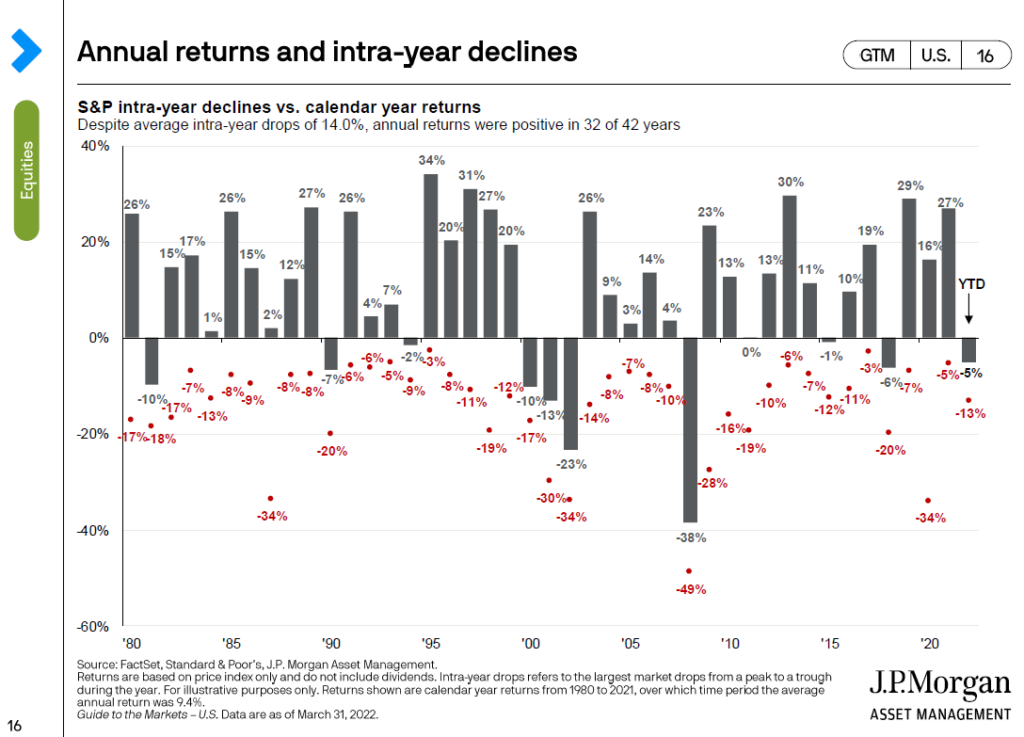

Against this background, we begin the rest of the year. The first quarter was not easy, but it served as a good reminder that financial markets do not just go up in the short term, despite what we have seen in recent years. These declines are never pleasant when you go through them, but they are opportunities to learn to live with the vagaries of the markets. The market drops an average of 14% within a year, but it has still been positive for 32 of the last 42 years (2nd chart). This learning will be useful when other difficult times arise, because yes, there will be others. The important thing in these moments is to stay invested and keep the long-term goal in mind. We let the storm pass and we don’t panic because it’s not the first time, nor the last time; and we have learned from past experiences that panicking won’t help us at all. And if you do panic and can’t do anything about it, call your investment advisor. After all, that’s what they’re there for.

In the coming months, there will be a lot to watch out for:

- Inflation trends

- Central bank activities

- Evolution of the conflict in Ukraine, which we all wish for a quick and peaceful resolution

- Covid-related changes expected to be less significant, but still worth watching

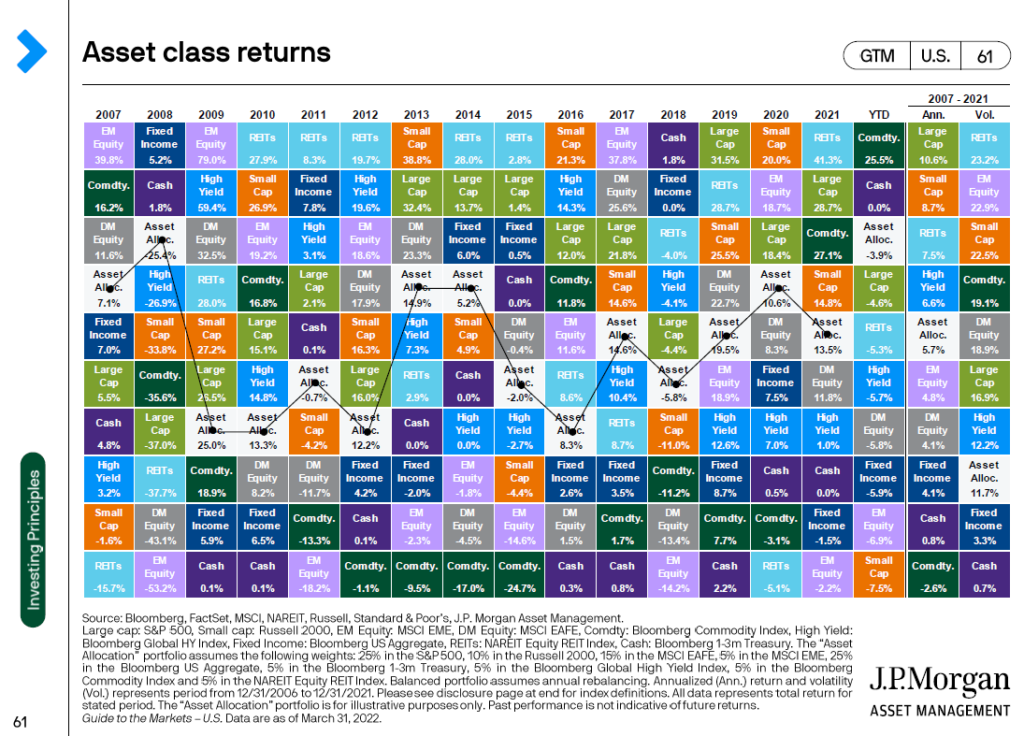

I expect volatile markets to persist and believe we will need to lower our expectations for future returns. The past few years have seen exceptional returns well above historical averages, especially in the U.S. market. For the next few years, and in the current context of high inflation, I think exposure to Canada will be attractive. The Canadian market is favorable with oligopolies (think banks and telecom companies for example) and a significant weighting in the energy sector. Company valuations are also much lower. Despite everything, the key will remain diversification. It is essential to have a well-diversified investment portfolio since unexpected events will continue to occur and it is through good diversification that we will be prepared for many eventualities. Investment themes evolve and change over time and we will continue to adjust the portfolios as needed. The table below shows the returns of different investments each year, as things can change a lot from one year to the next.

3. Closing remarks

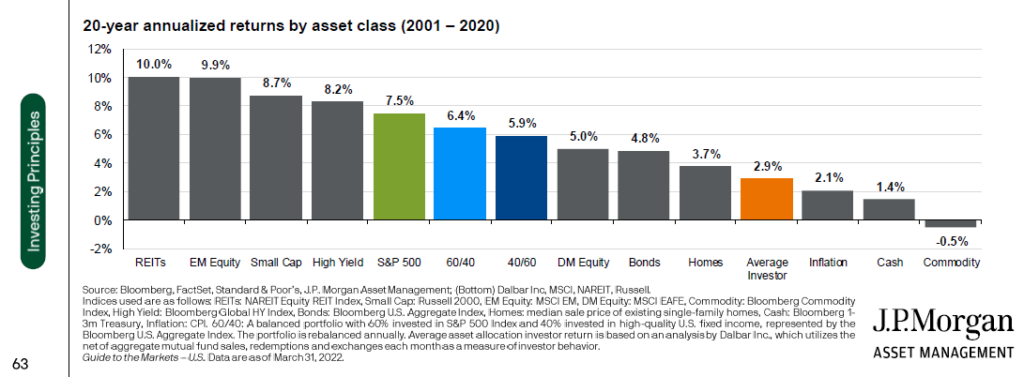

You will find in the appendix below other interesting charts on the effects of investors’ emotions on their returns and returns following market declines that I thought might interest you.

Of course, as I hope you all know, I remain at your entire disposal in case of need to answer your questions, fears, interrogations or other. Don’t hesitate, it’s always a pleasure for me to be there for you and that’s why I do this job. In addition, I have unlimited minutes on my phone!

Thank you for your trust.

ANNEX

Chart 1

The importance of staying invested. The average investor experiences significantly lower 20-year returns than a balanced portfolio, caused by behaviors that force them in when things are going well and out when they are not.

Chart 2

Corrections (10% drop) often offer good investment opportunities.