This is a nod to an article in La Presse (see here) that I found very interesting and colourful about the investor’s perspective and the psychological biases that often affect investment decisions.

Q4 2023 did not disappoint in terms of returns. In fact, November and December did most of the heavy lifting after three disappointing months in August, September and October. As stock markets never go in a straight line, when you look at the year as a whole, we had a year in three parts. From January to the end of July, most markets performed well. Then, from August to September was much more difficult, with some stock markets moving into correction territory (down 10% or more). Finally, to end the year on a high note, November and December were very good months for virtually all asset classes, with equities and bonds rising sharply.

If you only looked at your portfolio at the beginning of the year and at the very end, you’d think it was a very good year. A person who looks at their portfolio every day will also have had a very good year, but will have experienced a greater rollercoaster of emotions, with significant rises and falls at certain times throughout the year.

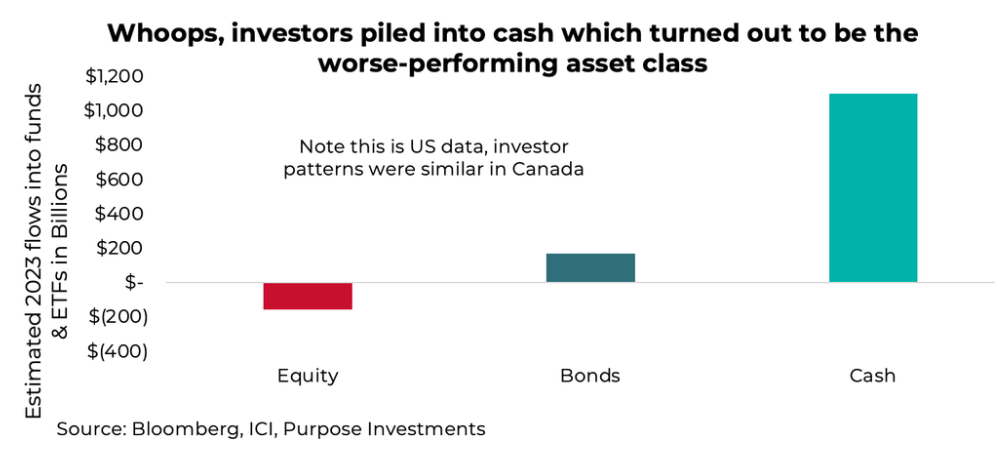

With this excellent market performance (especially in equities) in 2023, where do you think most people invested? Yes, in the asset class that returned the least for the year: cash. After a difficult 2022, investors’ appetite for risky assets was low; as if “buying when prices are low” is easier said than done. It is this aspect of behavioural finance that is discussed in the La Presse article mentioned above.

2023, like many years, brought its share of bad news. In addition to high inflation, we witnessed some of the biggest bank failures in history, with the collapse of Silicon Valley Bank, Signature Bank and First Republic in the US. While some were proclaiming the collapse of the US banking system, this proved not to be the case. Then, with the economy still firing on all cylinders and inflation still elevated, U.S. 10-year government bond yields reached 5% during the summer, the highest they’d been in over 15 years. Mortgage rates also hit their highest level since the early 2000s. As if that weren’t enough bad news, the war in Ukraine continued and a new war broke out between Israel and Hamas. Despite all this, many of the world’s stock markets had an excellent year.

100% chance of recession

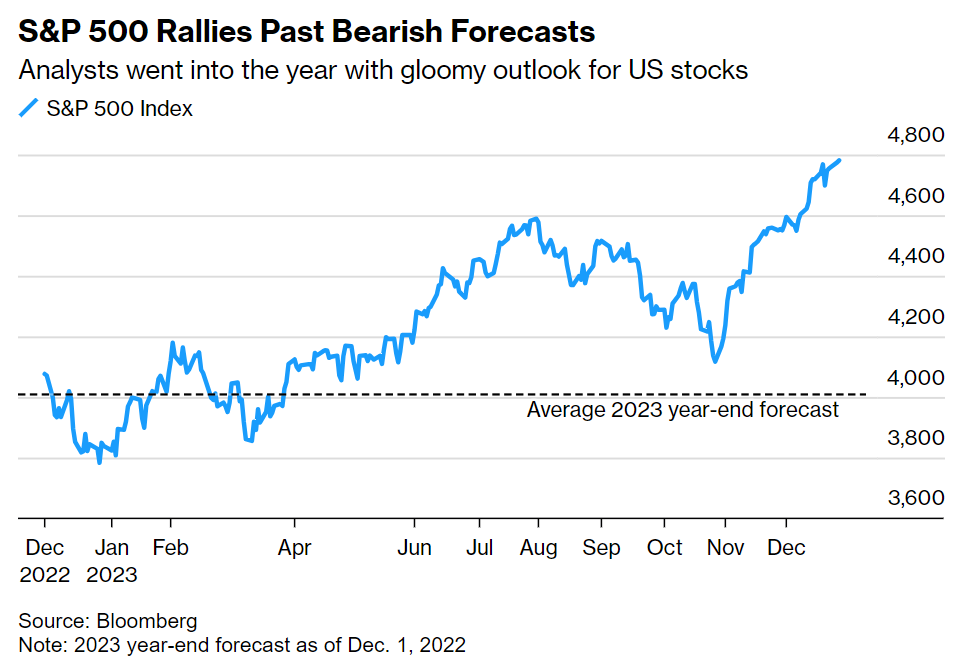

That’s what Bloomberg Economics’ probability models predicted for the next 12 months in October 2022 (source). This was not the only prediction made at the end of 2022 for the year 2023 that proved to be dead wrong. Indeed, when you look at the predictions made at the end of 2022, you quickly realize that the vast majority of strategists and forecasters completely missed it. While we were hearing about the most telegraphed recession in history, and the average analyst was predicting that the S&P500 stock market index would end 2023 at around 4,000, nothing of the sort happened. The US economy did not plunge into recession, and the S&P500 index ended the year at 4772, some 19% higher than forecast.

Strategists at the world’s largest financial institutions, such as Goldman Sachs, JPMorgan and Morgan Stanley, were predicting a difficult first half to 2023. In the end, the U.S. stock market, represented by the S&P500 index, rose by around 16% between January 1 and June 30, 2023.

As you’ve read or heard me say on several occasions, it’s impossible to predict short-term stock market results. Some people manage to do so from time to time, but they’ve often missed a good number of predictions before getting one right. What we do know is that, in the long run, the stock market goes up more often than it goes down, and that trying to predict its short-term movements is often more costly than letting the storms pass. All we need is the discipline and emotional control to keep our plan and objectives in sight when we’re in the eye of the storm.

The recession

Now that 2023 is over, that doesn’t mean the topic of a recession is closed. There’s always the possibility of one, both in Canada and the United States. In fact, it’s possible that we’re already in a recession in Canada because, as I mentioned in one of my previous articles (see here), recessions are usually formalized long after they’ve begun. In that article, I also covered the impact of recessions on stock markets and your portfolios.

The current economic situation is often compared to what happened between 1981 and 1982. In the early 1980s, the US Federal Reserve (FED) aggressively raised interest rates to combat high inflation. The U.S. stock market (S&P 500) fell 27% from peak to trough (compared with a 25% decline between January 4 and October 12, 2022). In the 12 months following the inflation peak, the US stock market rebounded strongly. Sound familiar?

The official dates of the 1981-1982 U.S. recession are July 1981 to November 1982. How did the U.S. stock market perform over this period, you ask? +9.76% in Canadian dollars. Why is that? Because, as I often say, financial markets are always looking to the future. Even if the situation at a given moment is difficult, if there’s a chance that it may improve in the future, that’s what the stock market will be looking at. That’s also why it’s not uncommon to see the stock market dip before recessions and rise during recessions.

For 2024

Inflation continues to make progress, but data like December’s show that the battle is not won. We should also have seen the ceiling on interest rates, with interest rate cuts expected later in 2024 for both Canada and the US. However, central banks around the world will continue to monitor inflation closely to determine the best time for the first rate cuts. They will want to avoid lowering rates too quickly, thereby creating a rebound in inflation that could lead to further problems.

The U.S. economy continues to do well, but the Canadian economy has slowed. You may recall from other articles that I mentioned the US economy was capable of sustaining more interest rate hikes than the Canadian economy; well, we’re now starting to see that difference materialize.

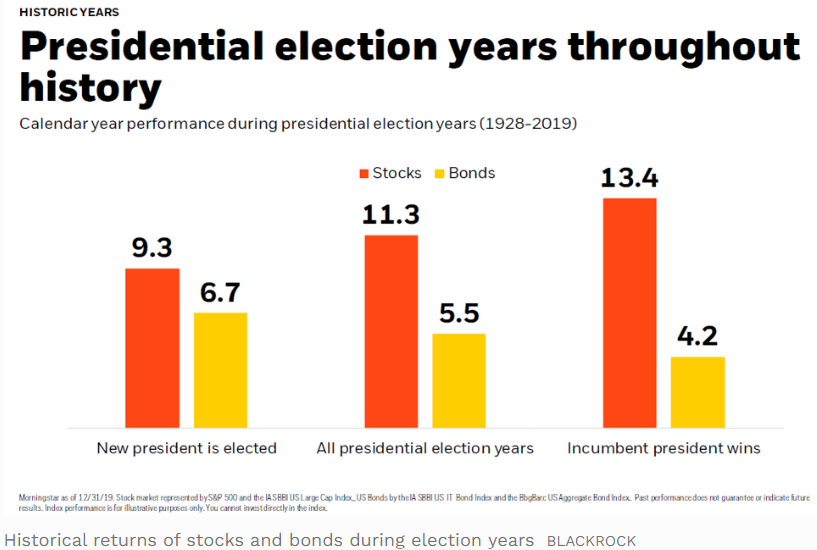

In conclusion, there will also be a presidential election in the United States in 2024. I won’t comment on the potential winner, but I will leave you on a positive note; in general, US presidential election years are good years for the stock market.

If you have any questions or would like to discuss this further, please do not hesitate to contact us.

This information has been prepared by Mathieu Garand who is an investment advisor at iA Private Wealth Inc. and does not necessarily reflect the opinion of iA Private Wealth. The information contained in this newsletter comes from sources we believe reliable, but we cannot guarantee its accuracy or reliability. The opinions expressed are based on an analysis and interpretation dating from the date of publication and are subject to change without notice. Furthermore, they do not constitute an offer or solicitation to buy or sell any of the securities mentioned. The information contained herein may not apply to all types of investors. The investment advisor can open accounts only in the provinces in which they are registered. iA Private Wealth Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. iA Private Wealth is a trademark and business name under which iA Private Wealth Inc. operates.